Technical Analysis Tools— Cycles

Technical Analysis Tools— Continuation Patterns

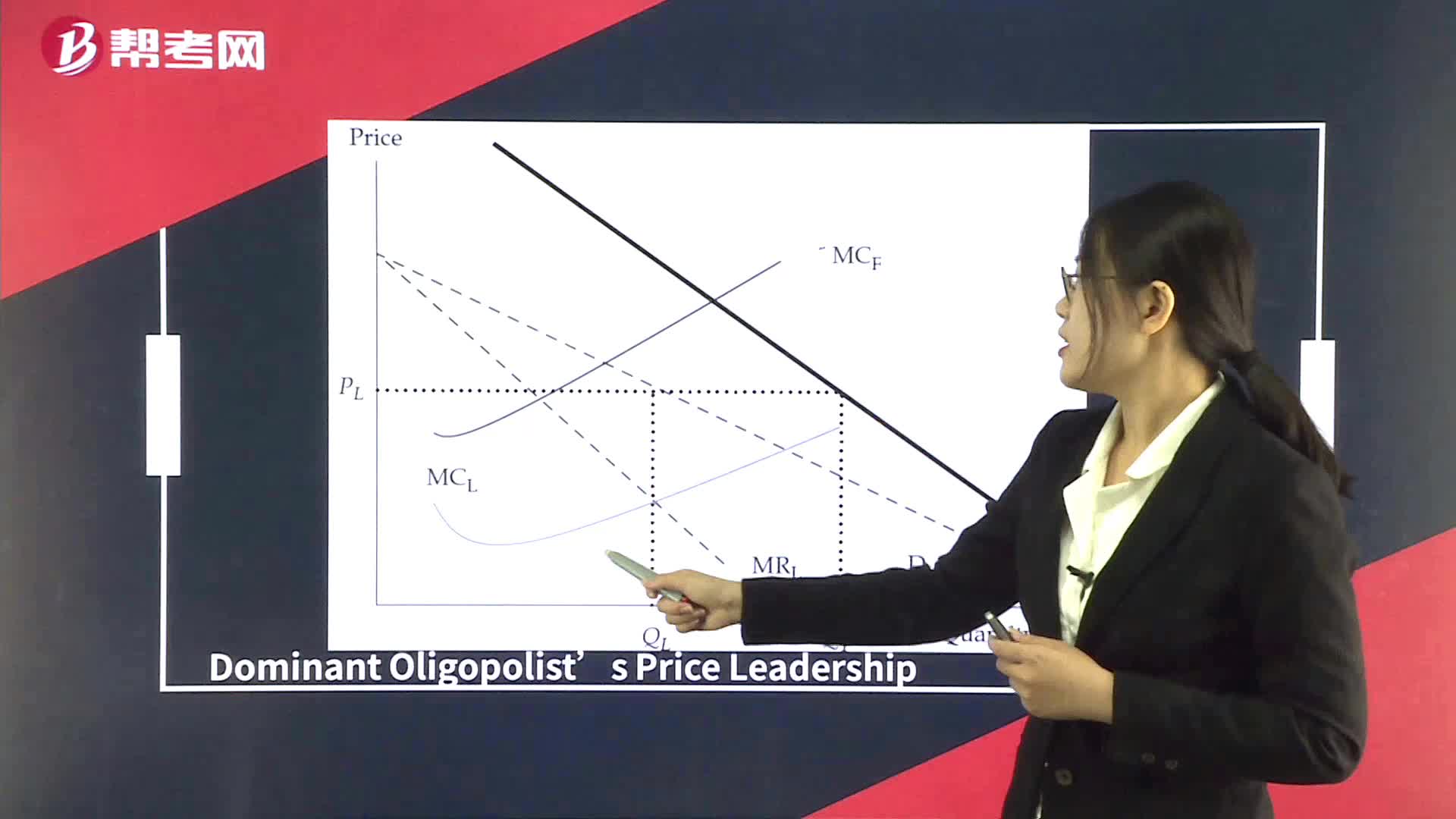

Supply Analysis in Oligopoly Market

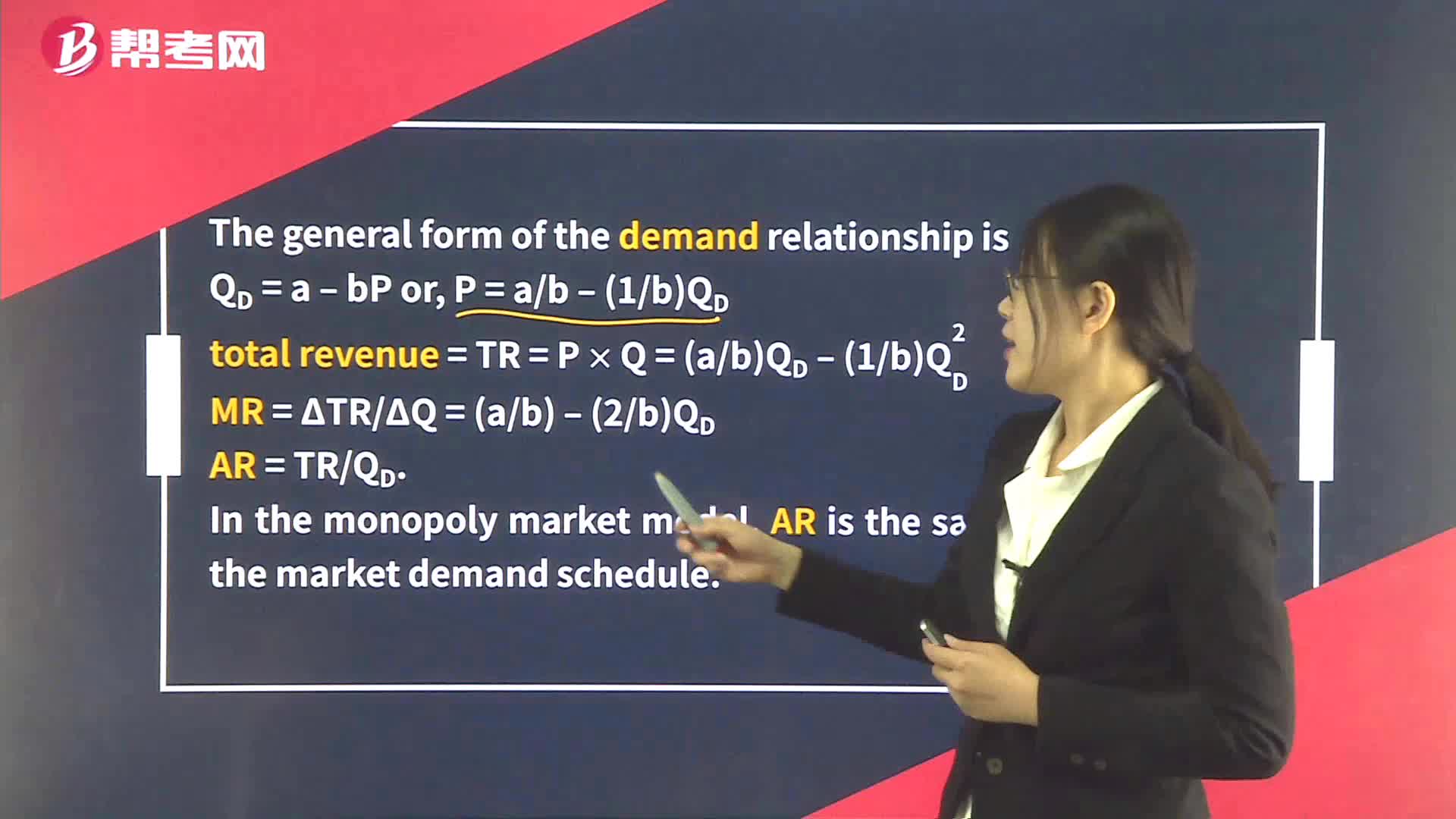

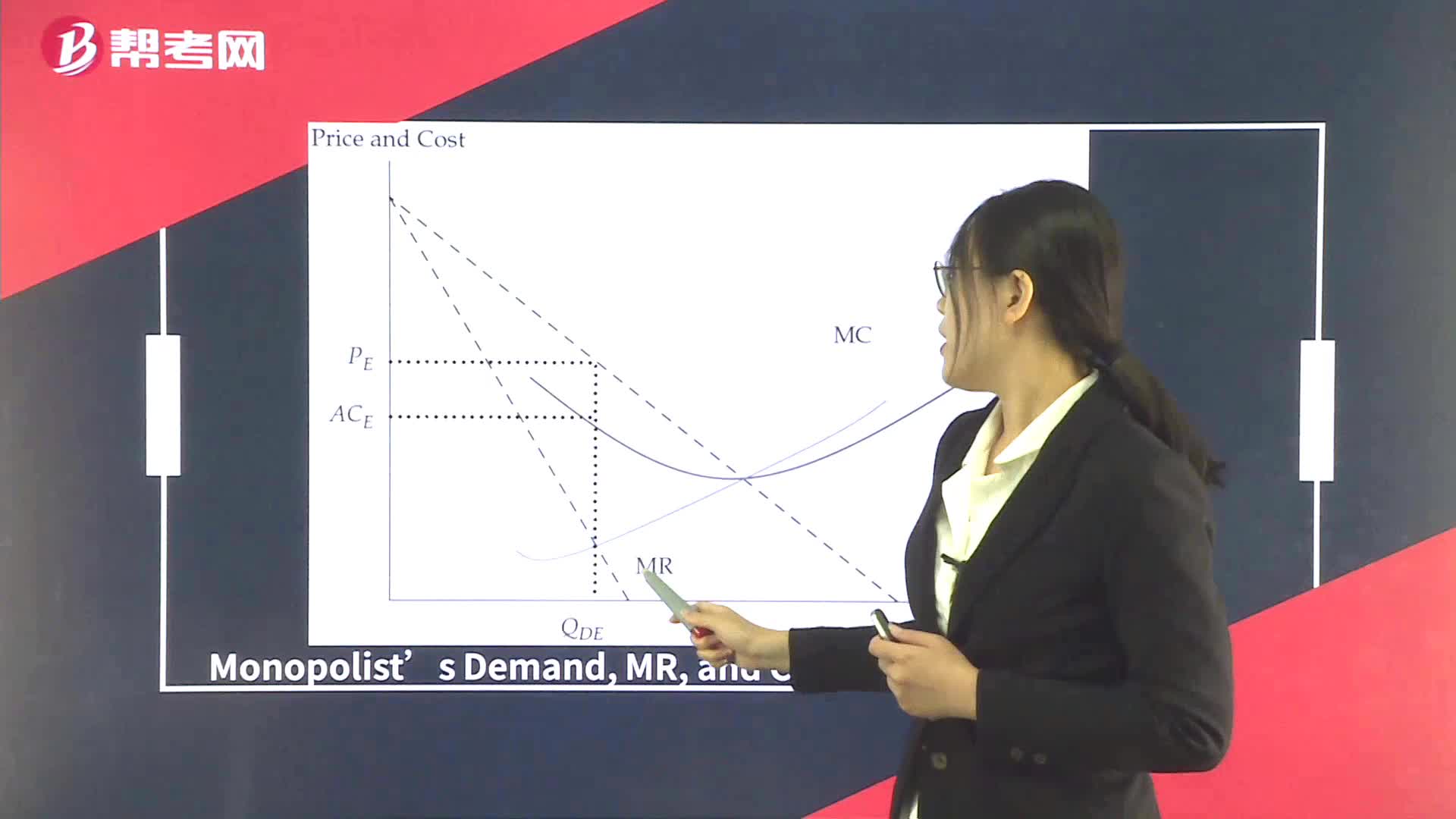

Supply Analysis in Monopoly

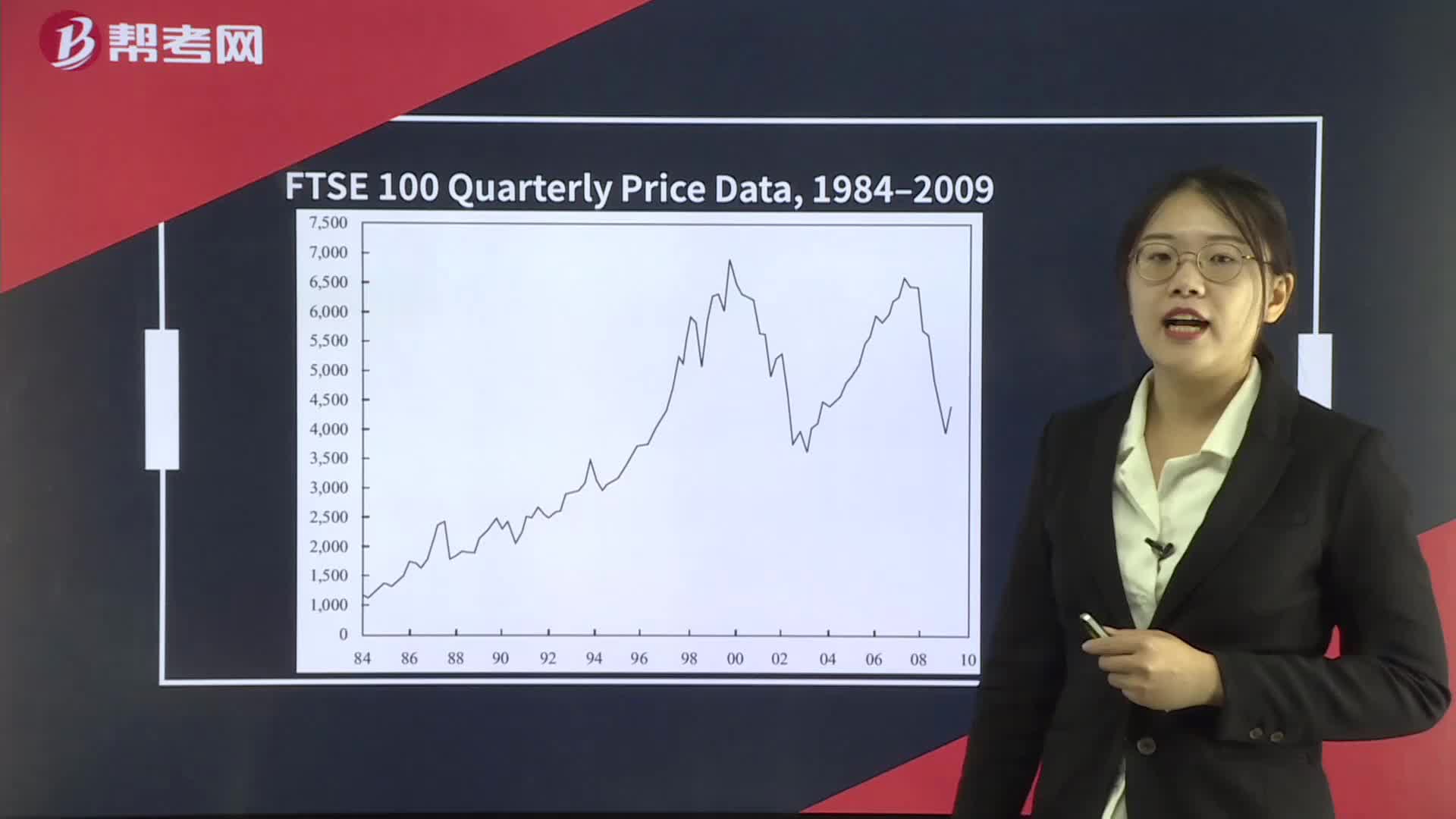

Technical Analysis Tools— Charts

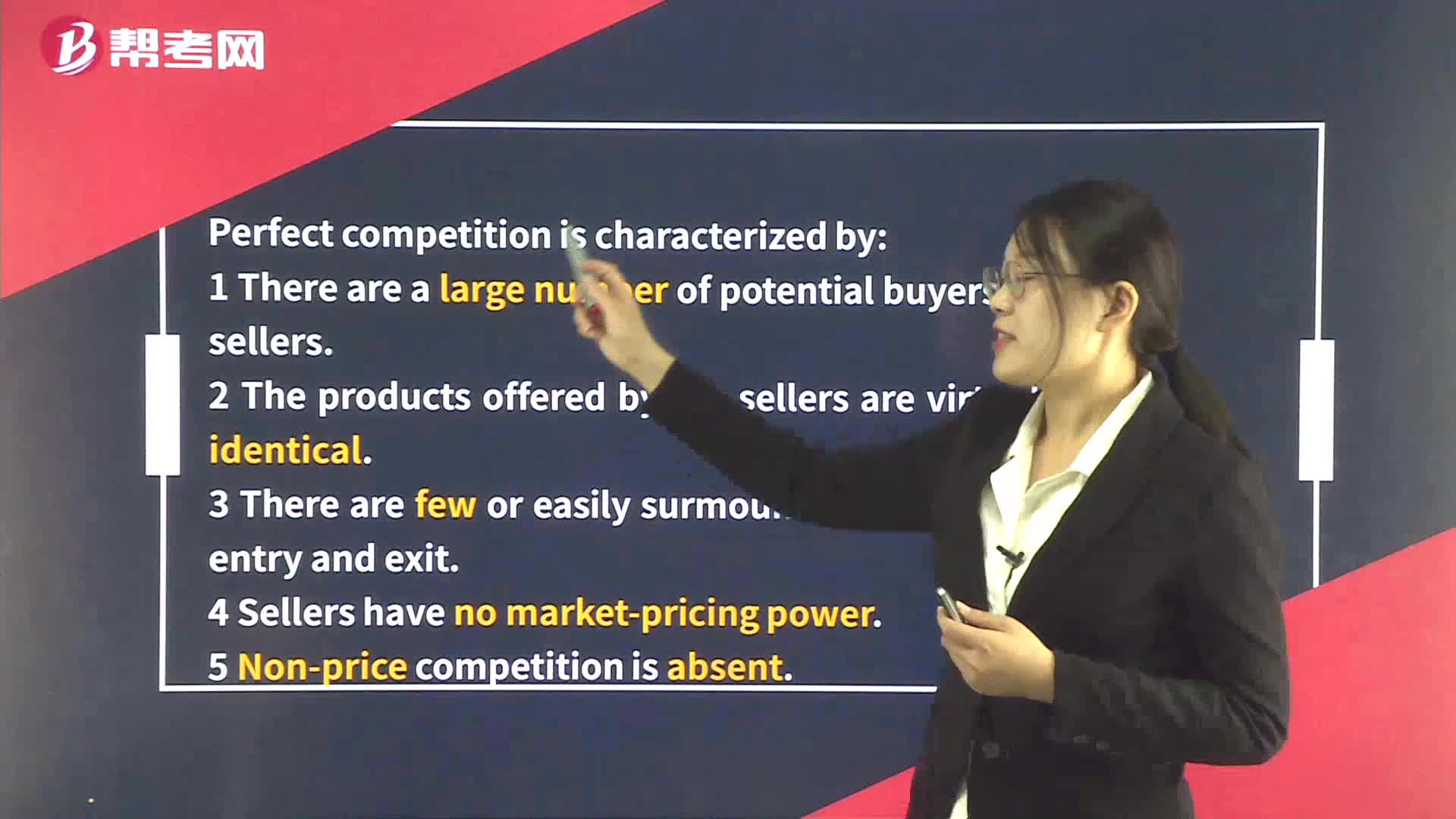

Supply Analysis in Monopolistic Competition

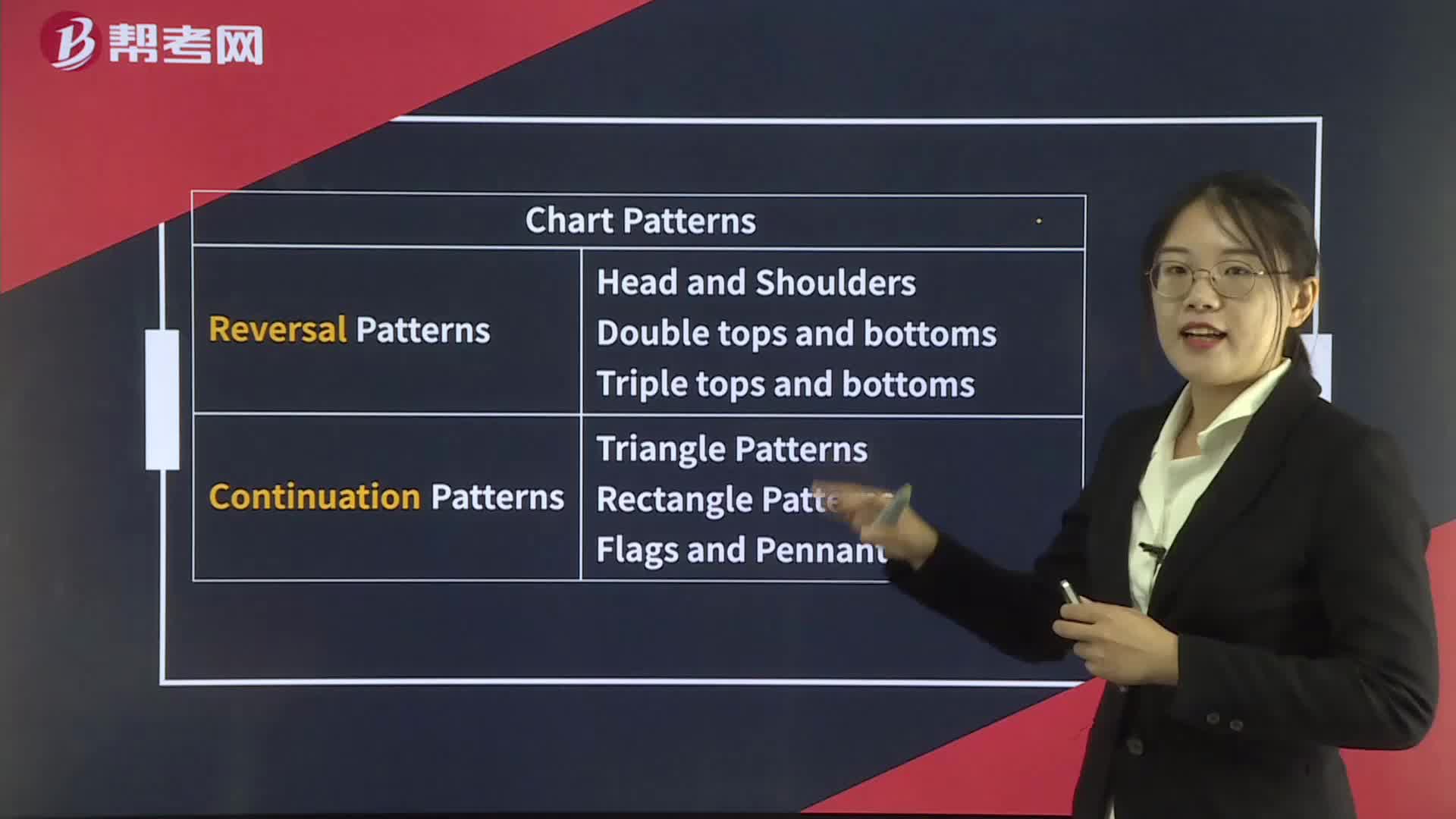

Technical Analysis Tools— Chart Patterns

Technical Analysis Tools— Chart Patterns Summary

Intermarket analysis

Management Commentary or Management’s Discussion and Analysis

Scope of Financial Statement Analysis

Breakeven Analysis

下載億題庫(kù)APP

聯(lián)系電話:400-660-1360