Breakeven Analysis

幫考網(wǎng)校2020-08-06 13:59:18

Breakeven analysis is a financial tool used by businesses to determine the minimum amount of sales needed to cover all of their costs and expenses. It is a useful tool for business owners to understand their cost structure and profitability.

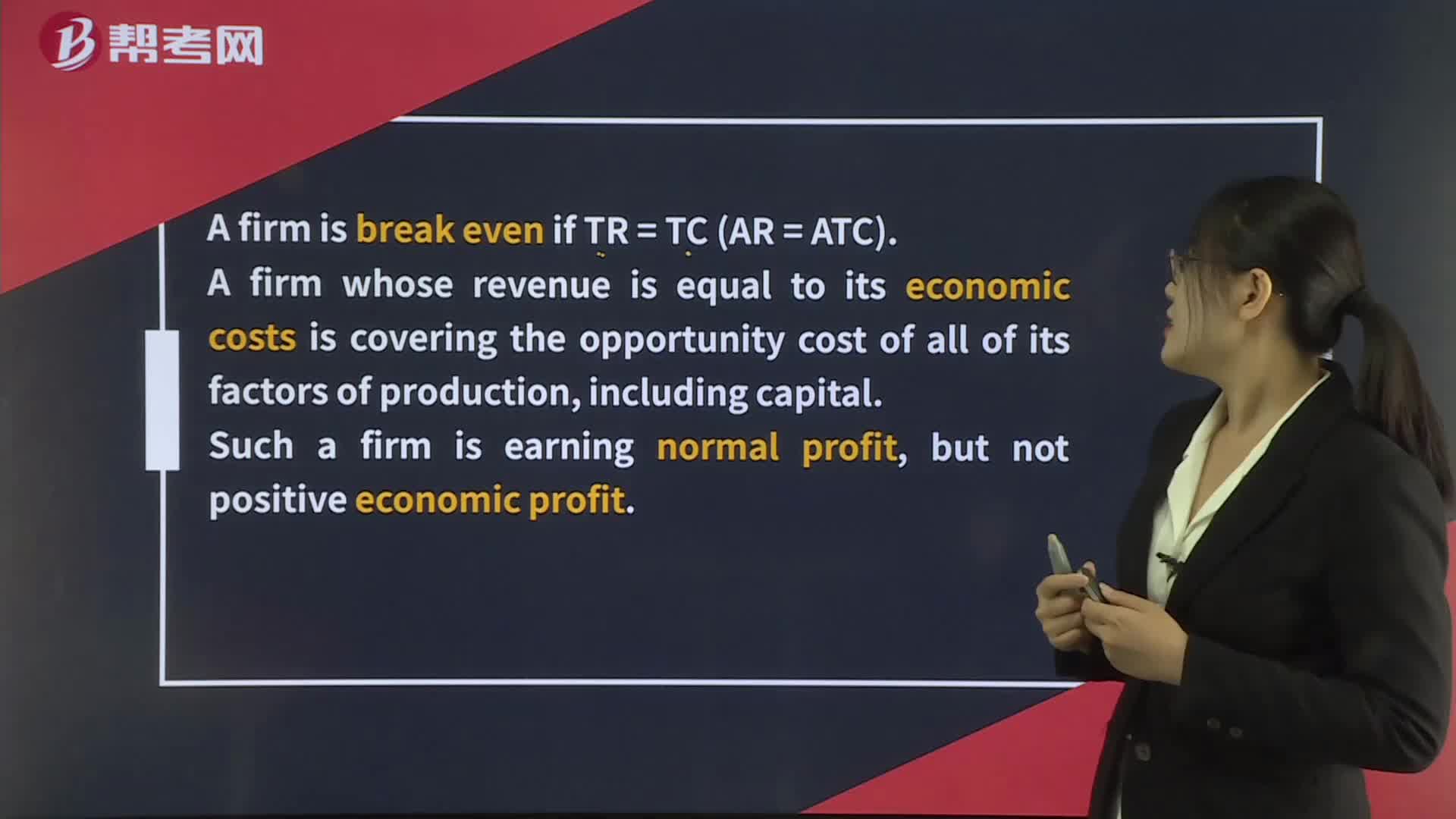

The breakeven point is the point at which total revenue equals total costs. It is the point where a business is neither making a profit nor a loss. Any sales above the breakeven point will generate a profit, while any sales below the breakeven point will result in a loss.

To calculate the breakeven point, a business needs to know its fixed costs, variable costs, and selling price per unit. Fixed costs are the costs that do not change regardless of the level of production or sales, such as rent, salaries, and insurance. Variable costs are costs that vary with the level of production or sales, such as raw materials and labor. Selling price per unit is the price at which a product is sold.

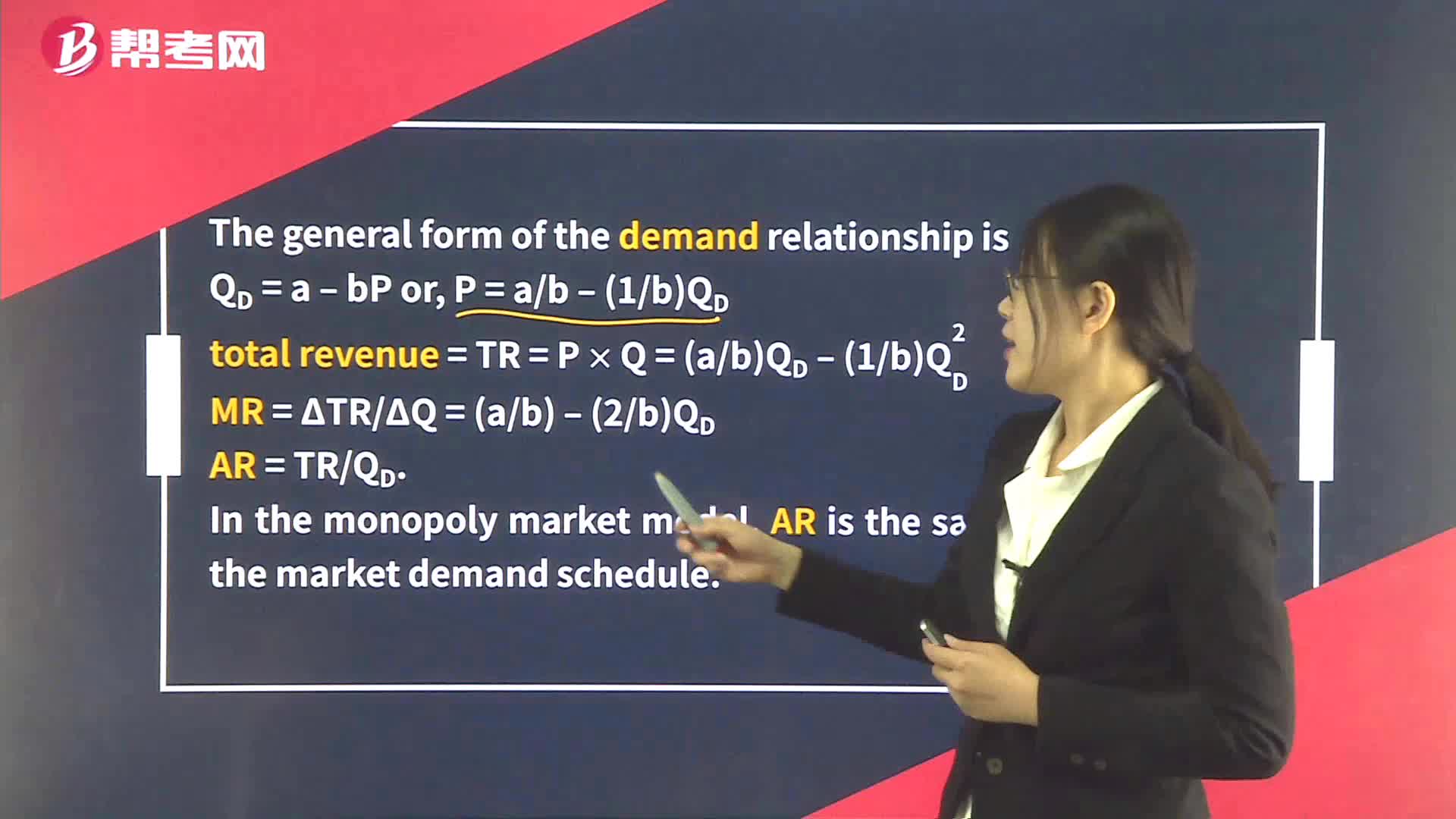

The formula for calculating the breakeven point is:

Breakeven point = Fixed costs / (Selling price per unit - Variable costs per unit)

For example, if a business has fixed costs of $10,000, a selling price per unit of $50, and variable costs per unit of $30, the breakeven point would be:

Breakeven point = $10,000 / ($50 - $30) = 500 units

This means that the business needs to sell 500 units to cover all of its costs and expenses. Any sales above 500 units will generate a profit, while any sales below 500 units will result in a loss.

Breakeven analysis is a useful tool for businesses to determine their pricing strategy, cost structure, and profitability. It can help businesses make informed decisions about their operations and financial performance.

幫考網(wǎng)校

幫考網(wǎng)校