Composition of Interest Rates

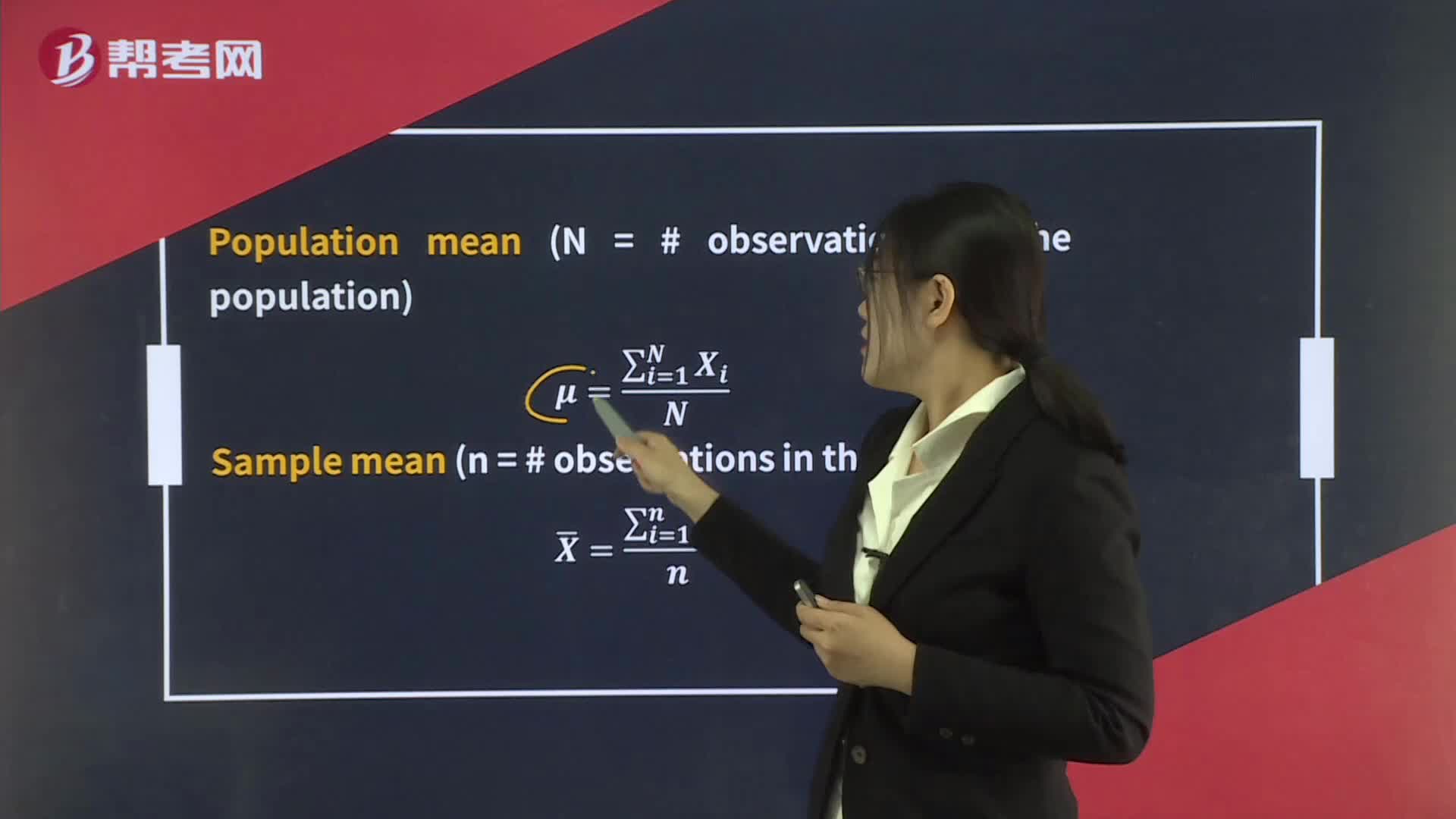

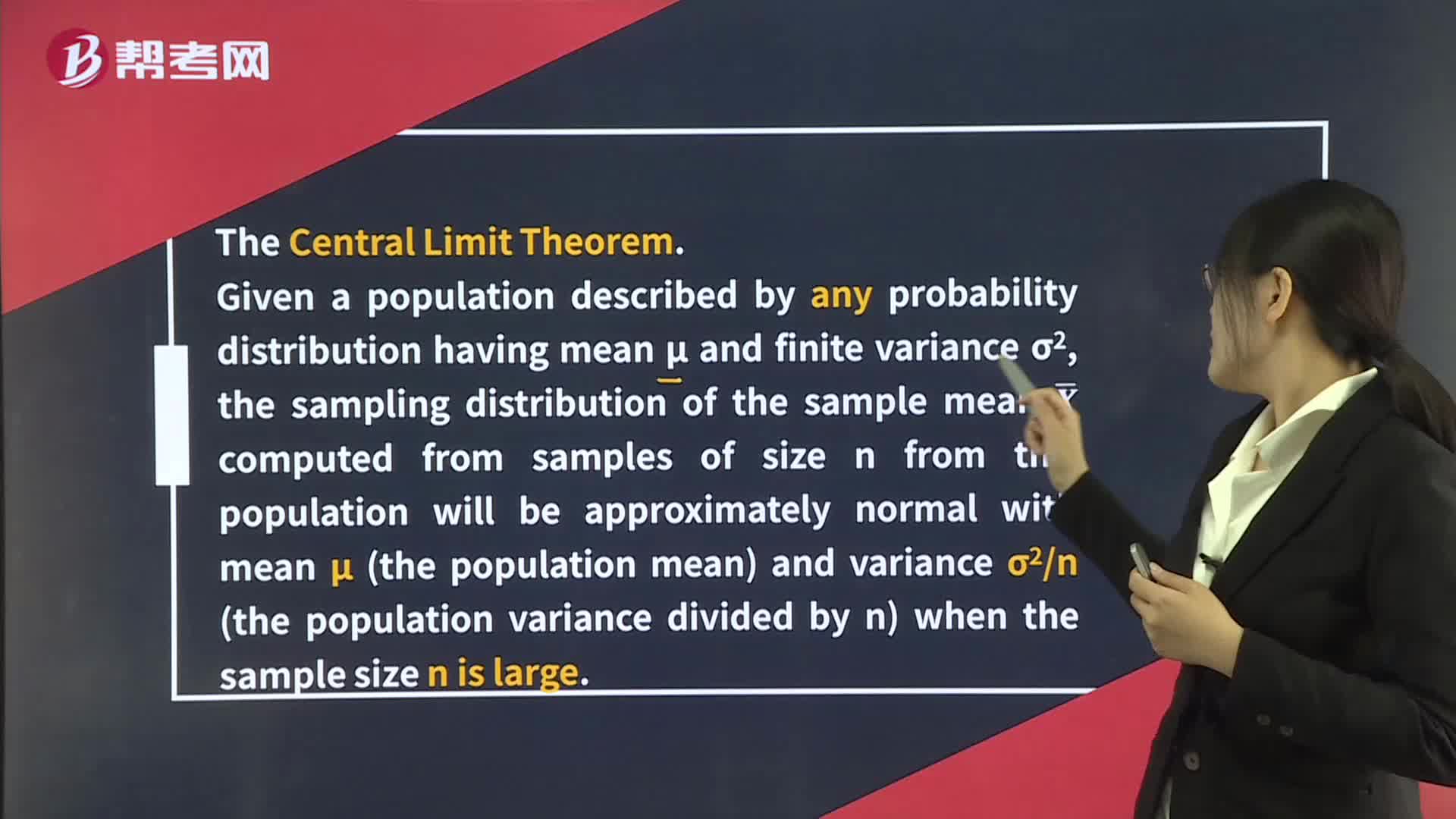

Distribution of the Sample Mean

The Time Value of Money

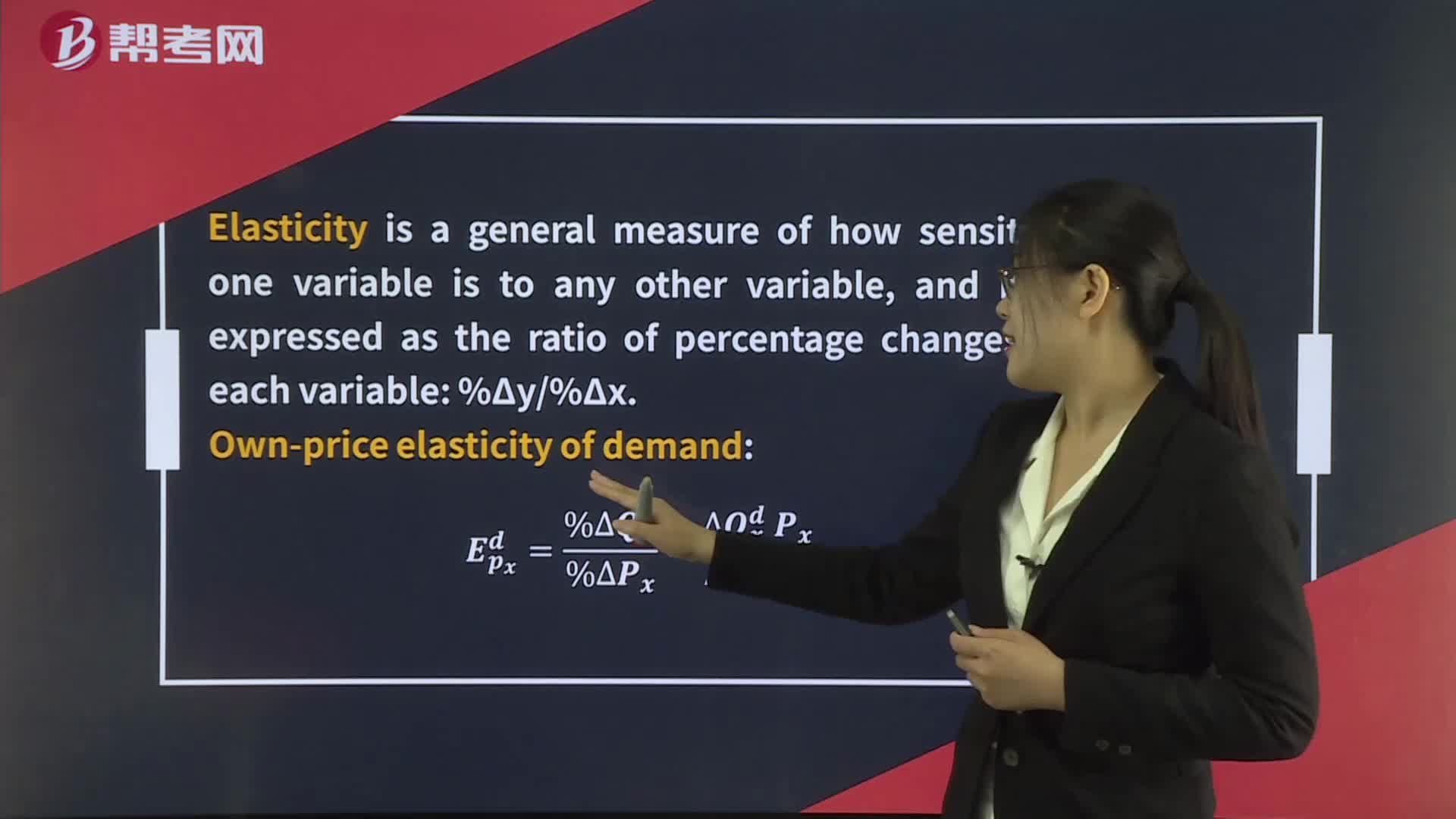

Own-Price Elasticity of Demand

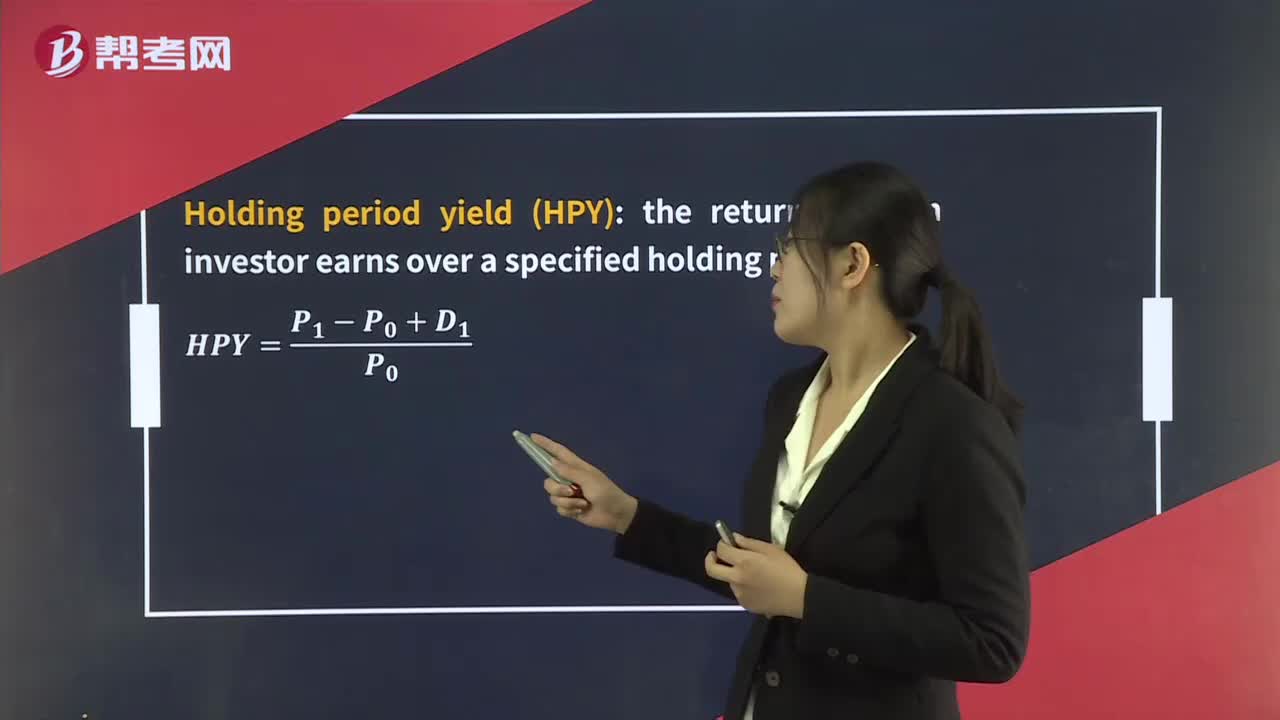

Money-Weighted Rate of Return & Time-Weighted Rate of Return

Exchange Rates, International Trade, and Capital Flows

Interest Rates

Currency Regimes – Independently Floating Rates

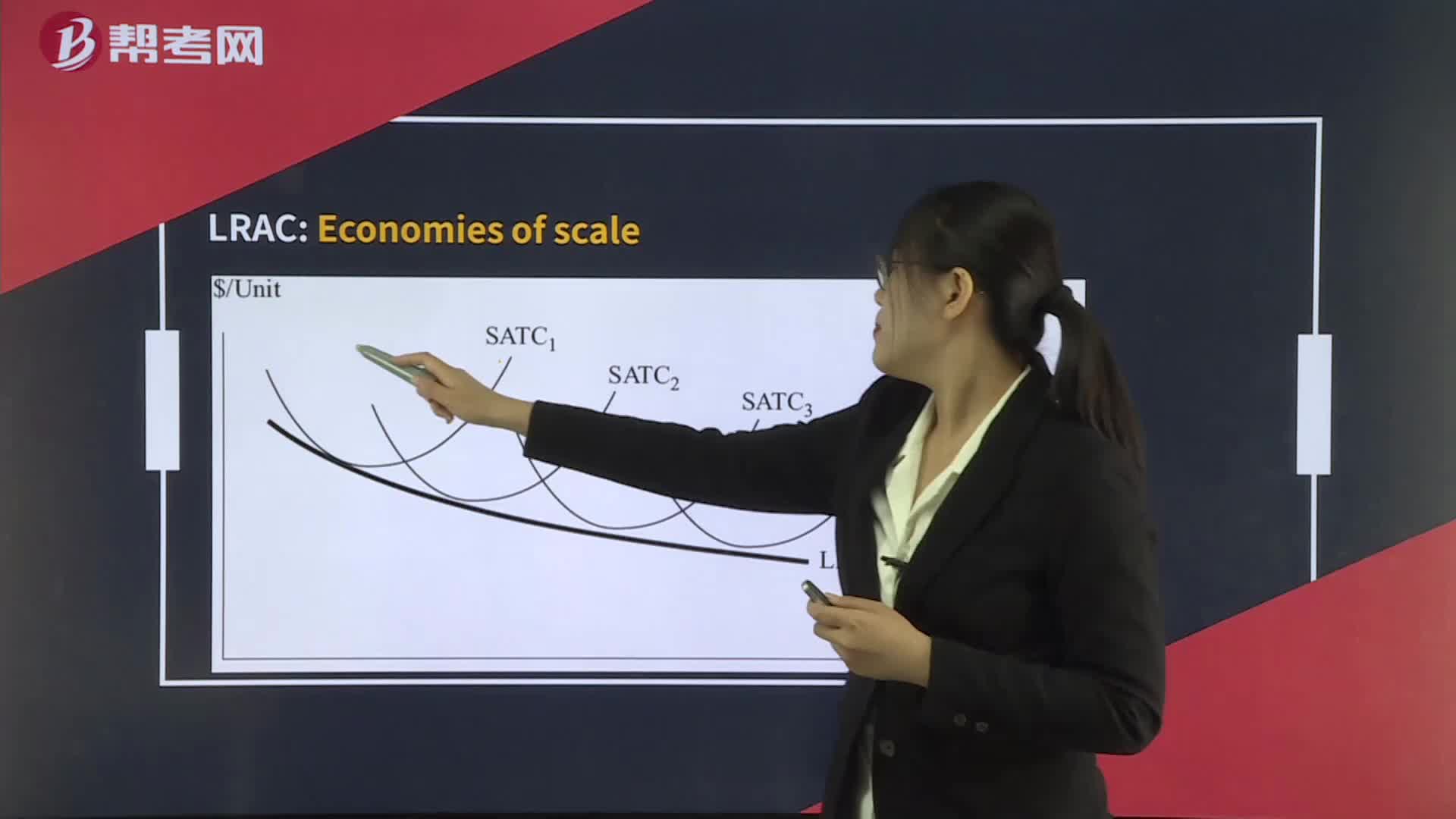

Economies of Scale and Diseconomies of Scale

Nominal and Real Exchange Rates

The Quantity Theory of Money

Income Statement– Minority Interest

下載億題庫(kù)APP

聯(lián)系電話:400-660-1360