Technical Indicators— Price-based Indicators

Technical Indicators— Momentum Oscillators

Technical Indicators— Flow-of-Funds Indicators

Technical and Fundamental Analysis

Technical Analysis

Technical Analysis Tools— Trend

Technical Analysis Tools— Technical Indicators

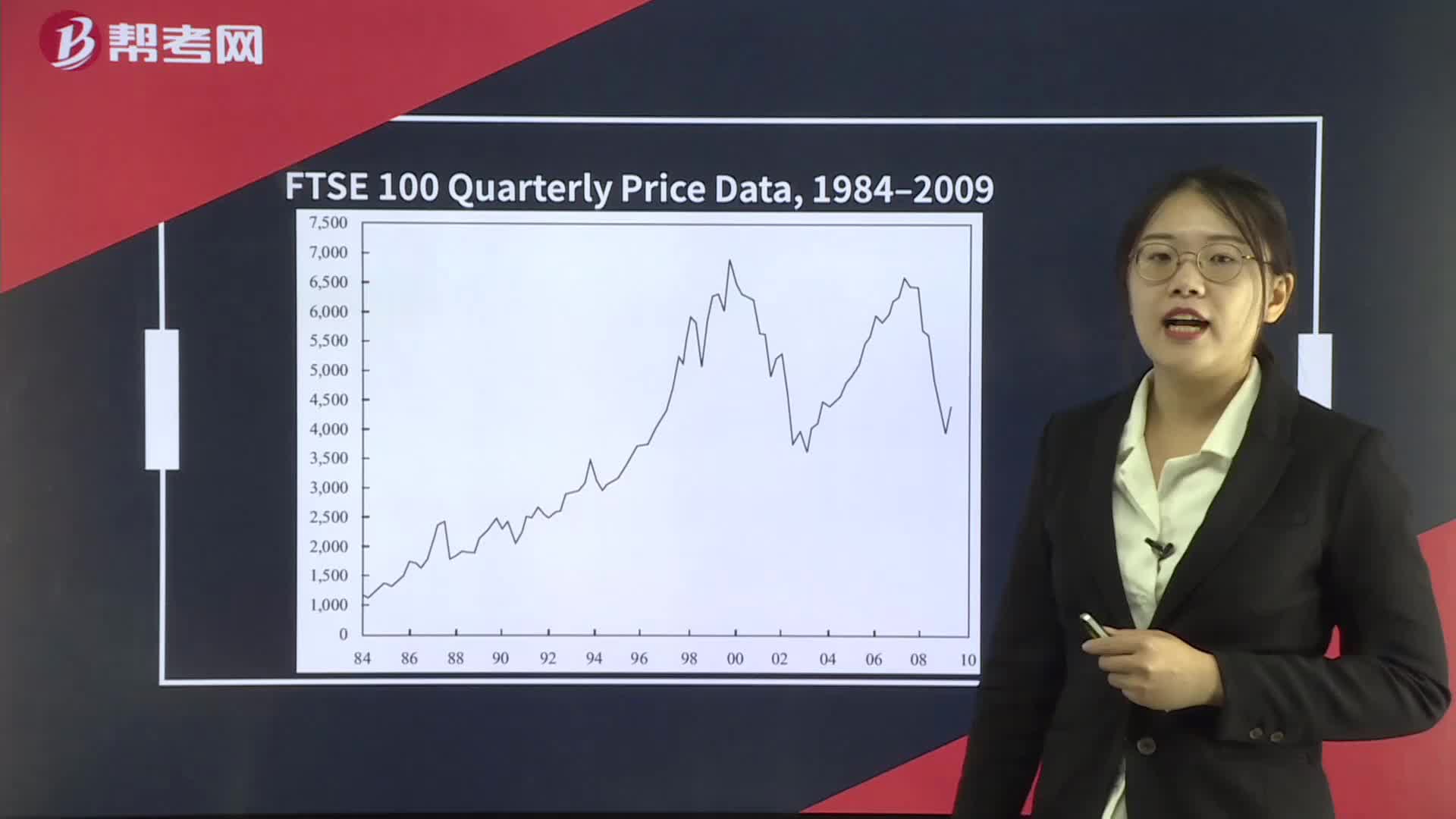

Technical Analysis Tools— Charts

Technical Analysis Tools— Chart Patterns

Price Discrimination

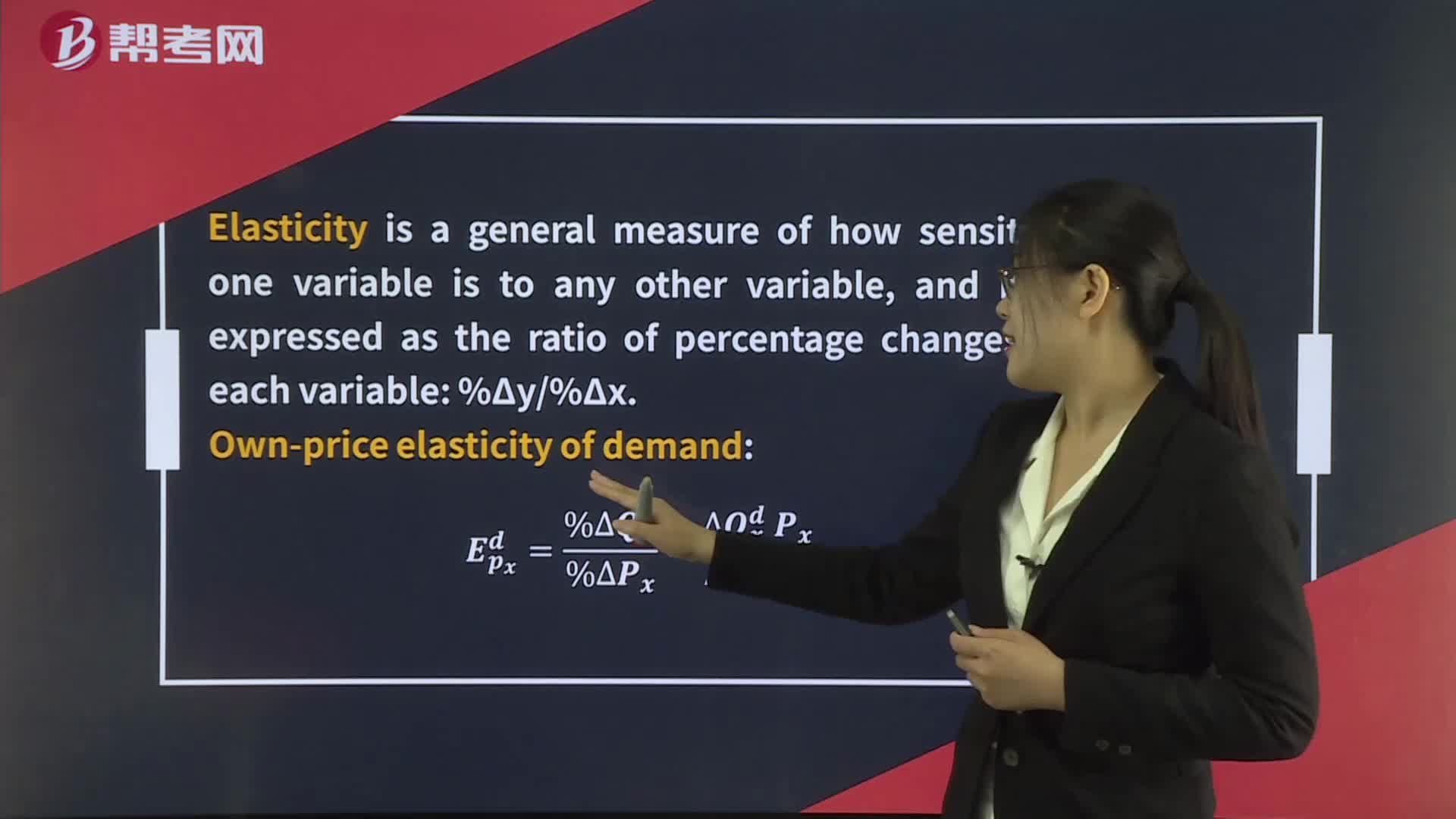

Own-Price Elasticity of Demand

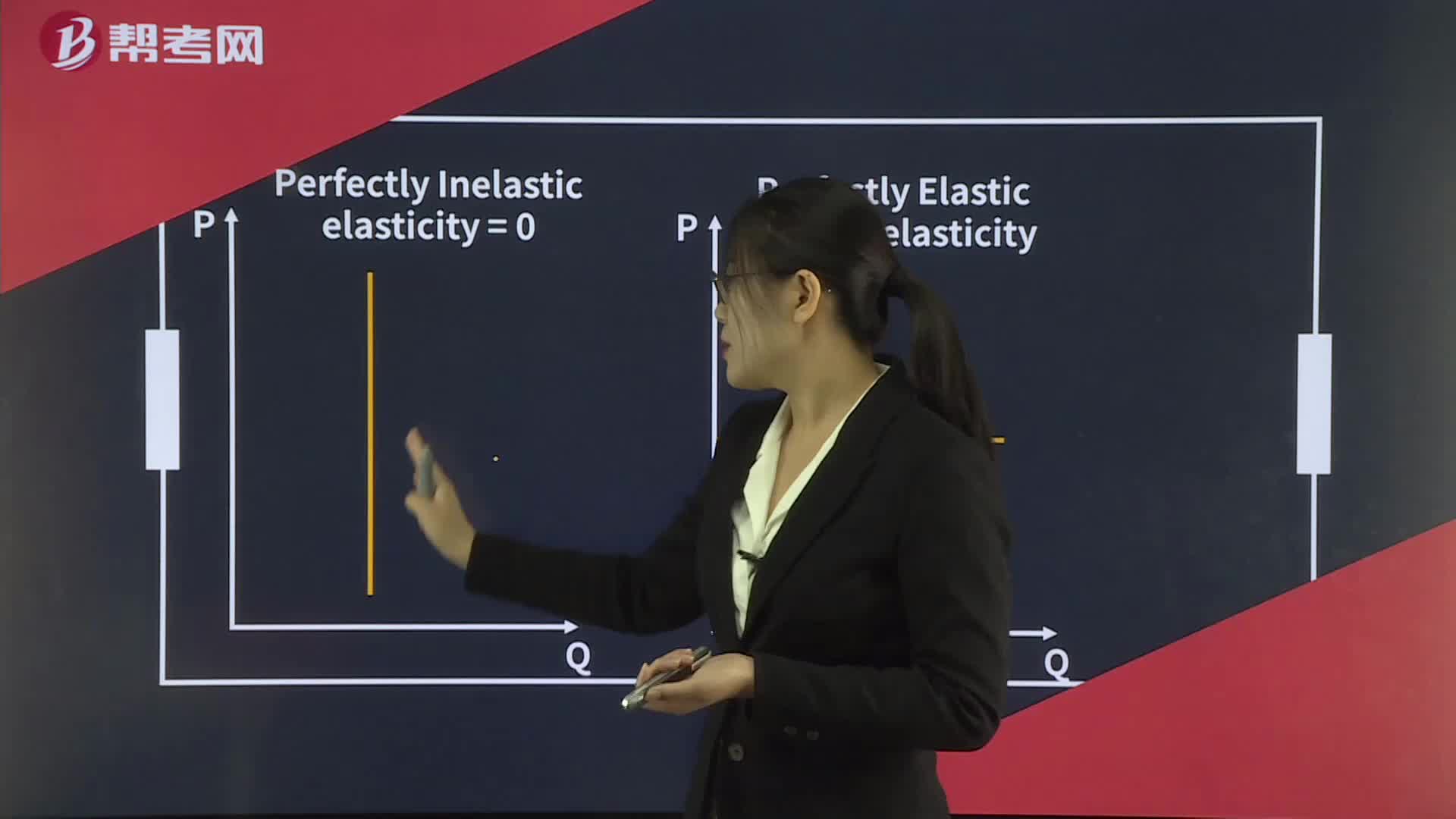

Extremes of Price Elasticity

下載億題庫(kù)APP

聯(lián)系電話:400-660-1360