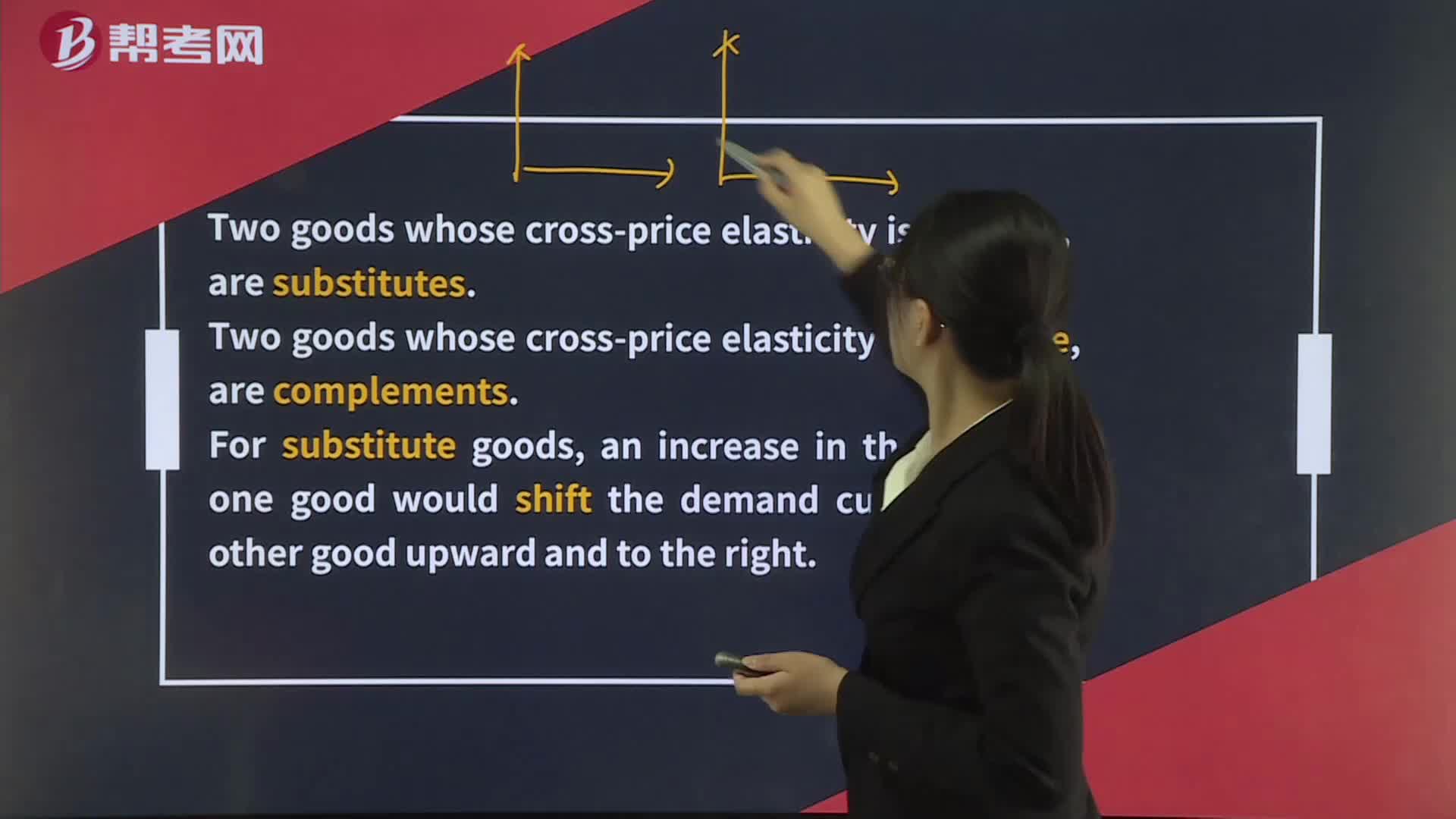

Cross-Price Elasticity of Demand

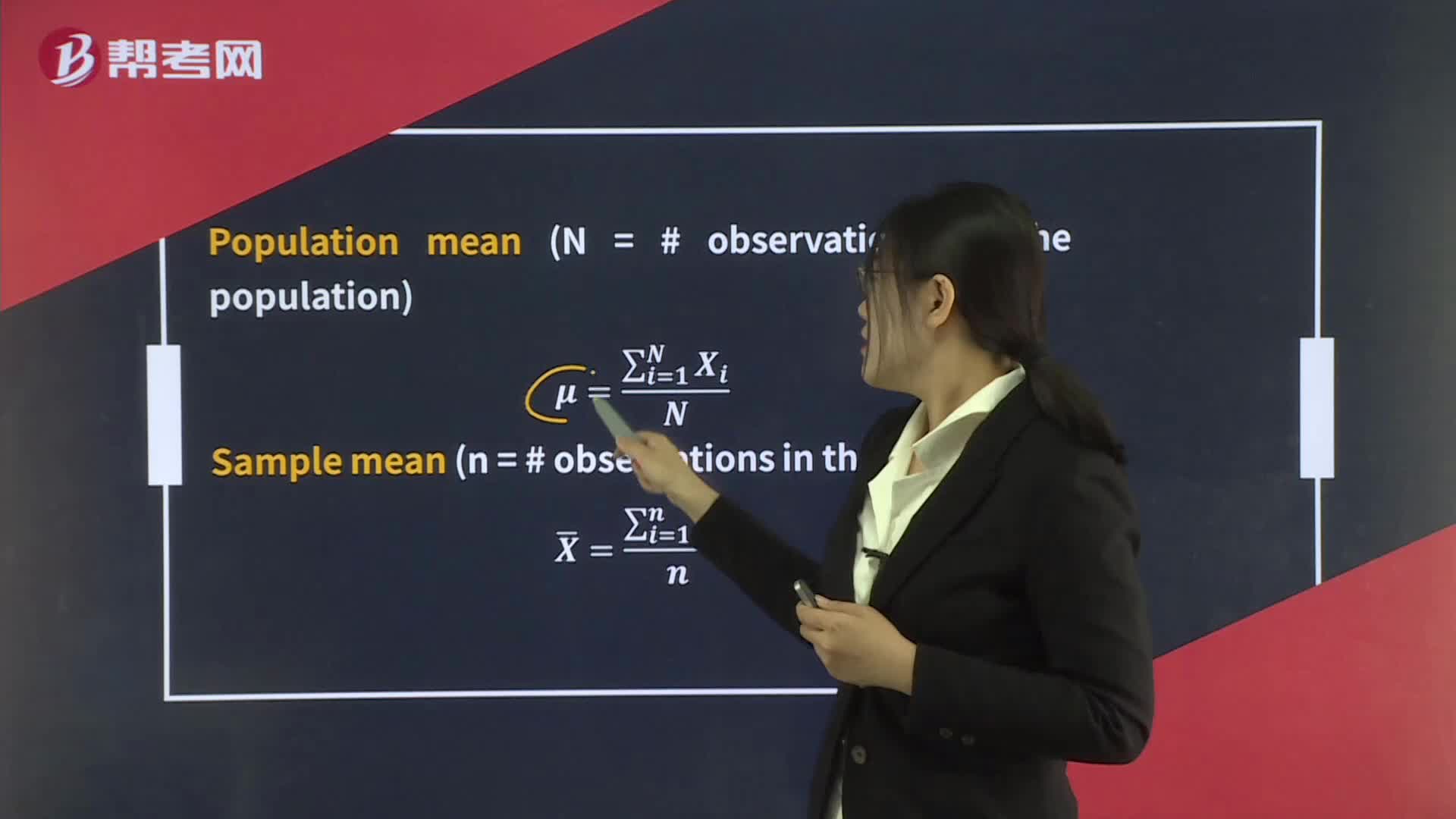

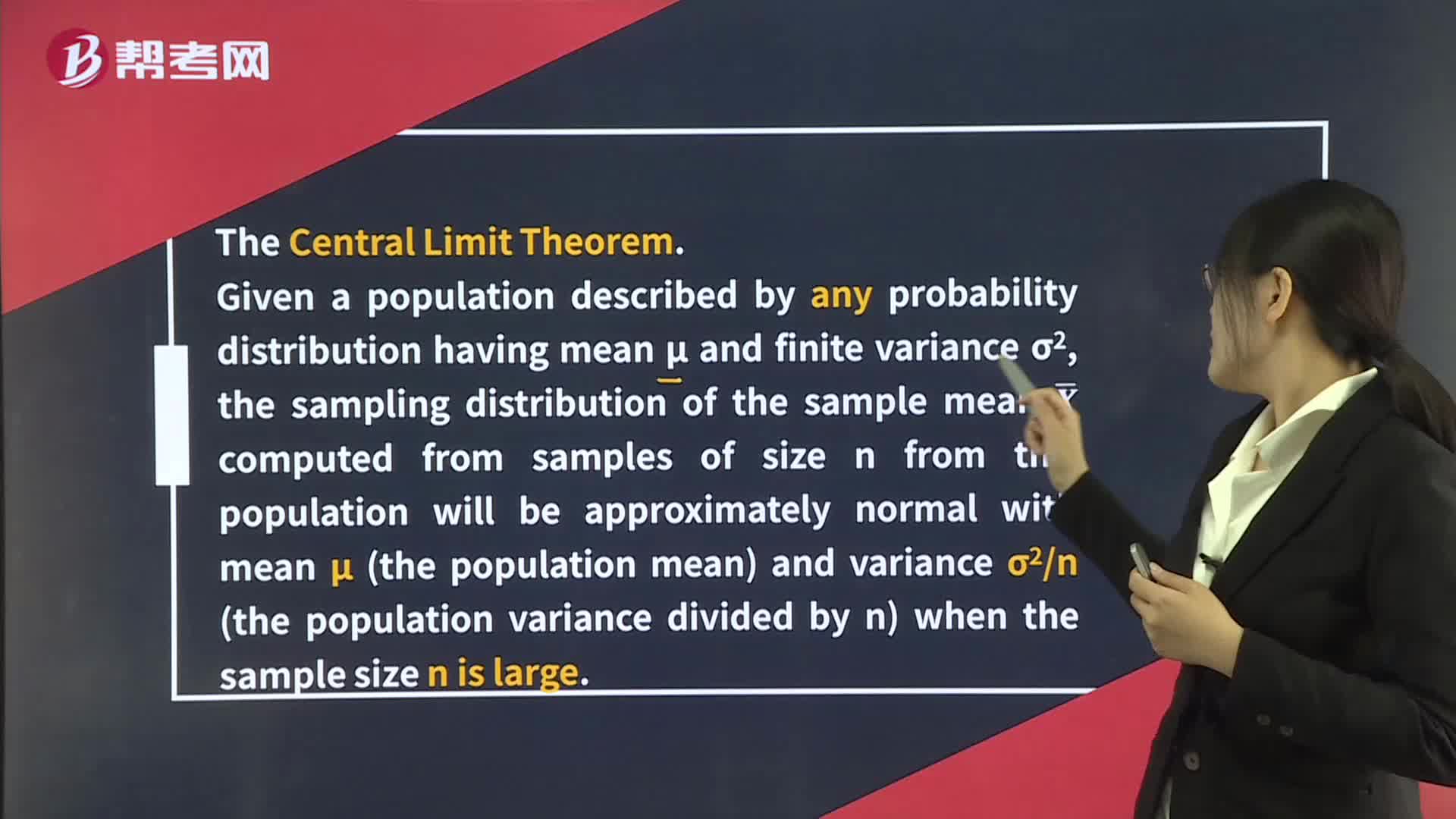

Distribution of the Sample Mean

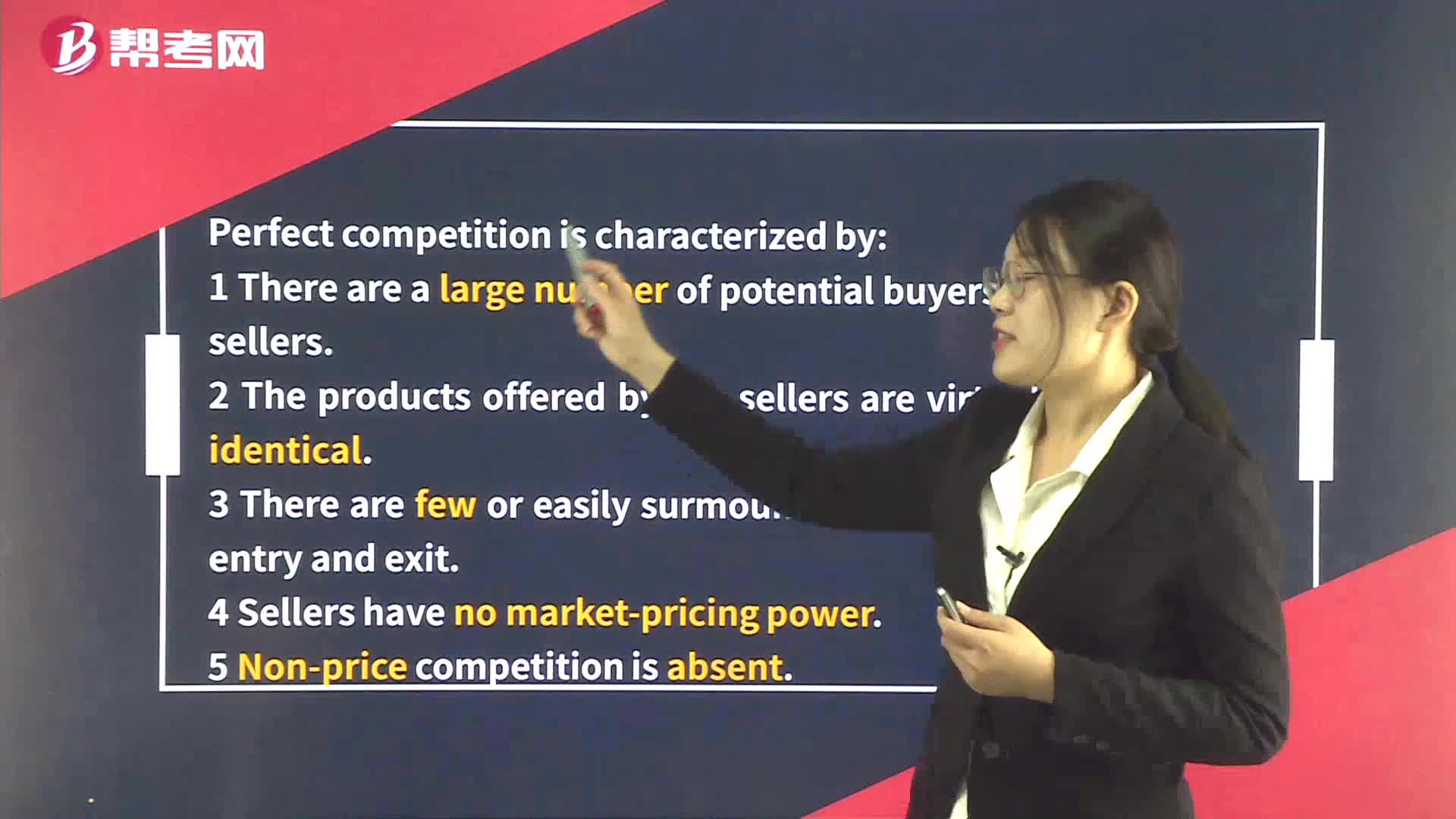

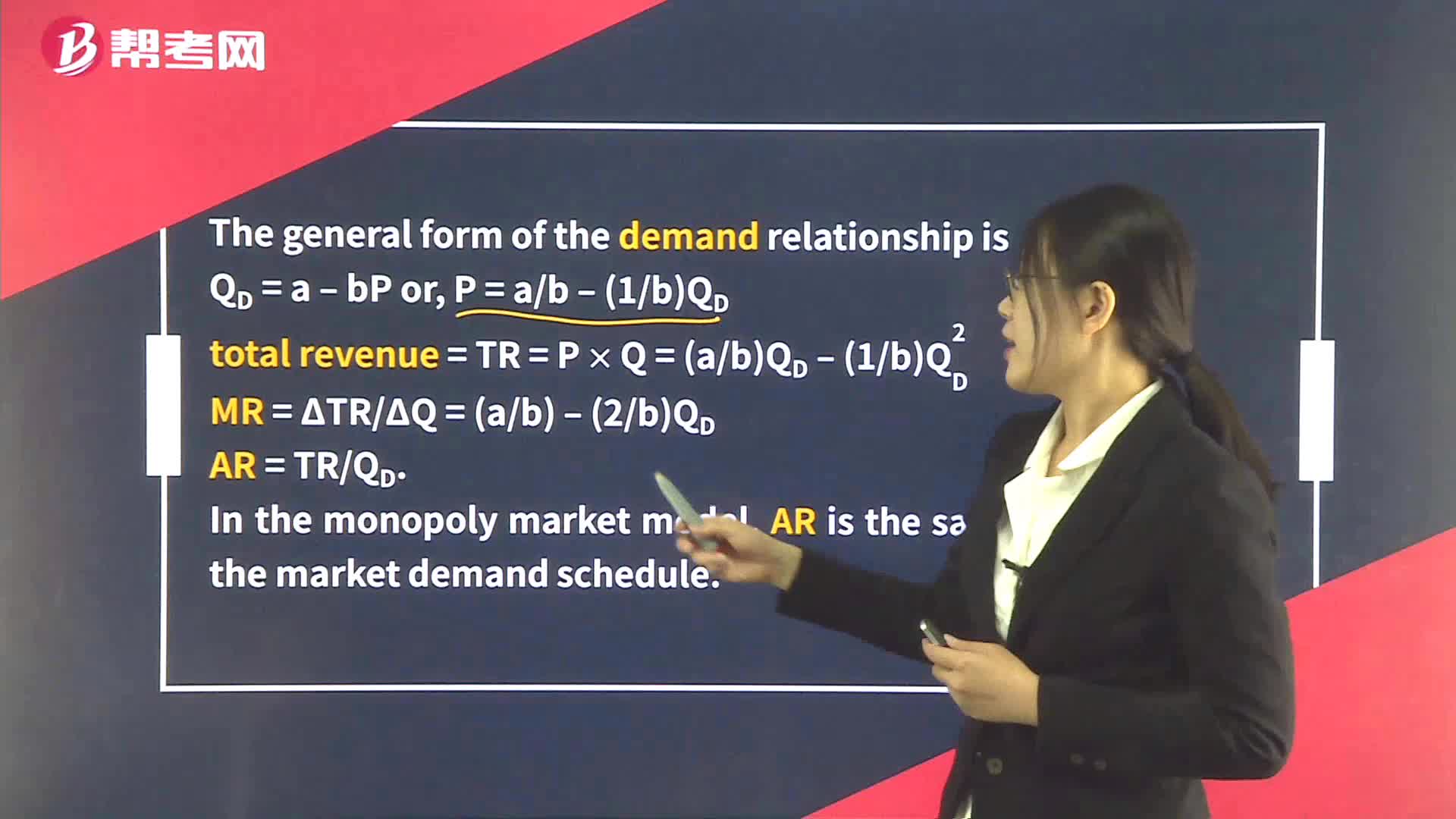

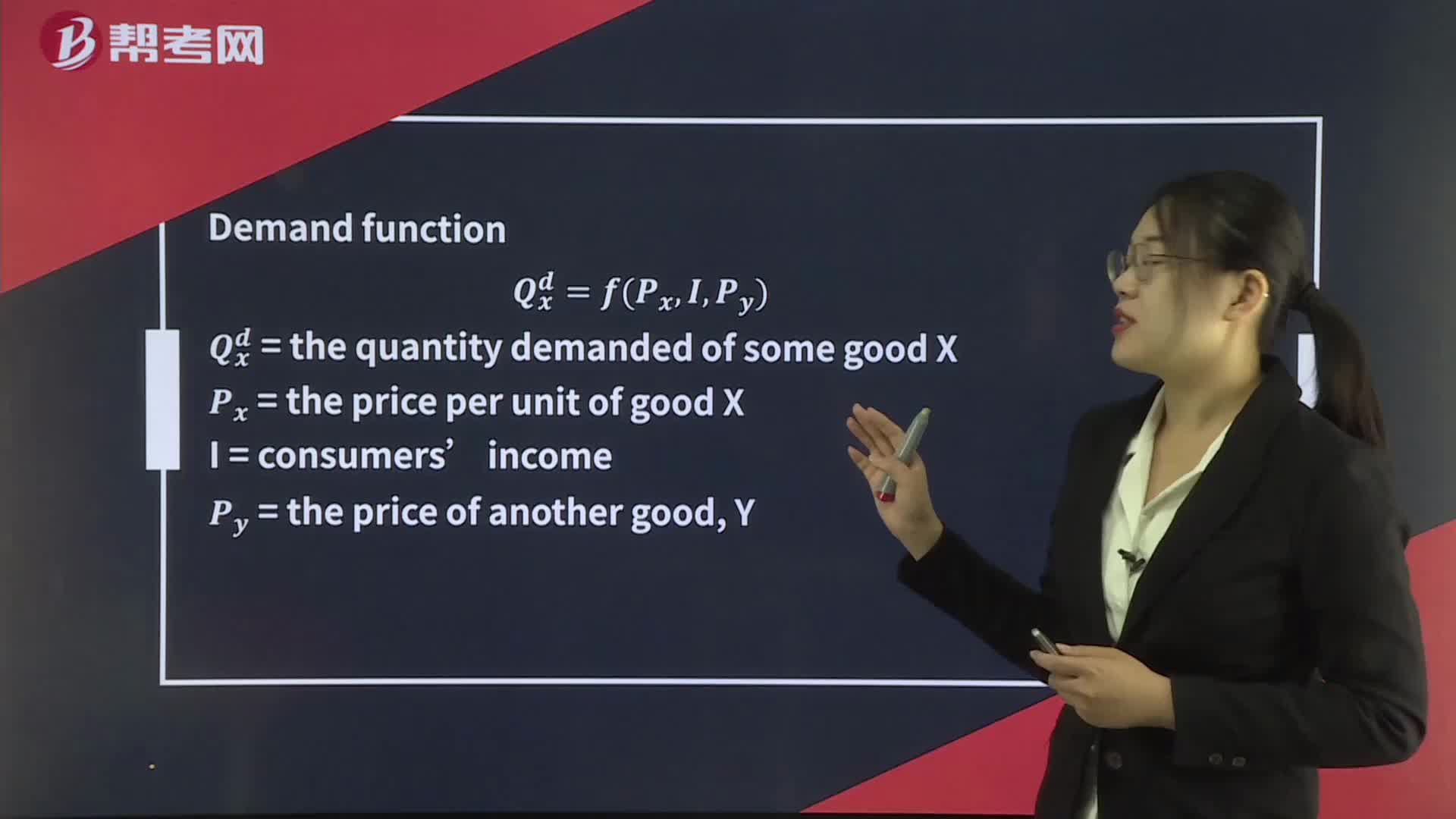

Demand Analysis:The Consumer

The Quantity Theory of Money

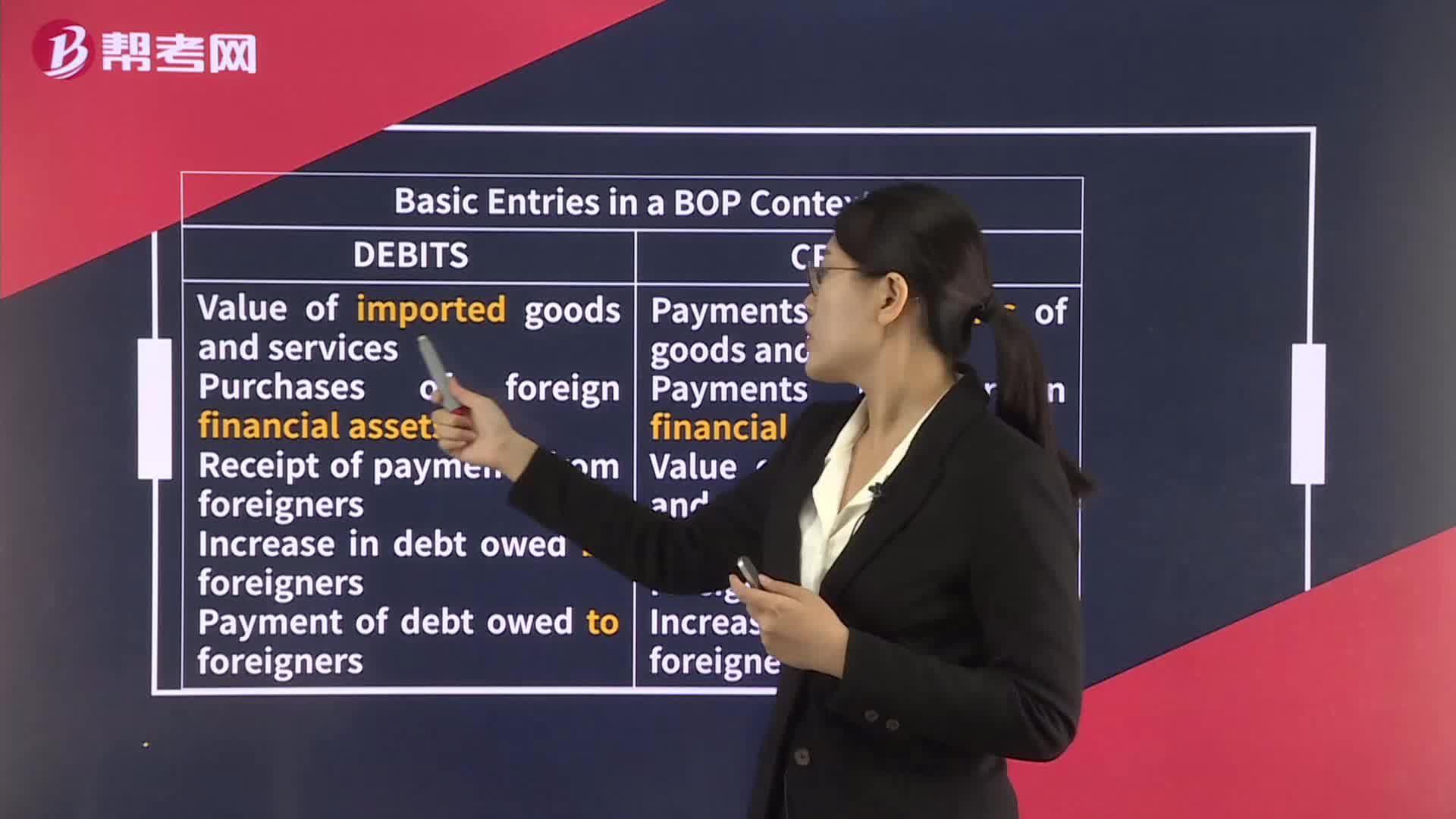

Balance of Payments Accounts

Balance of Payment Components

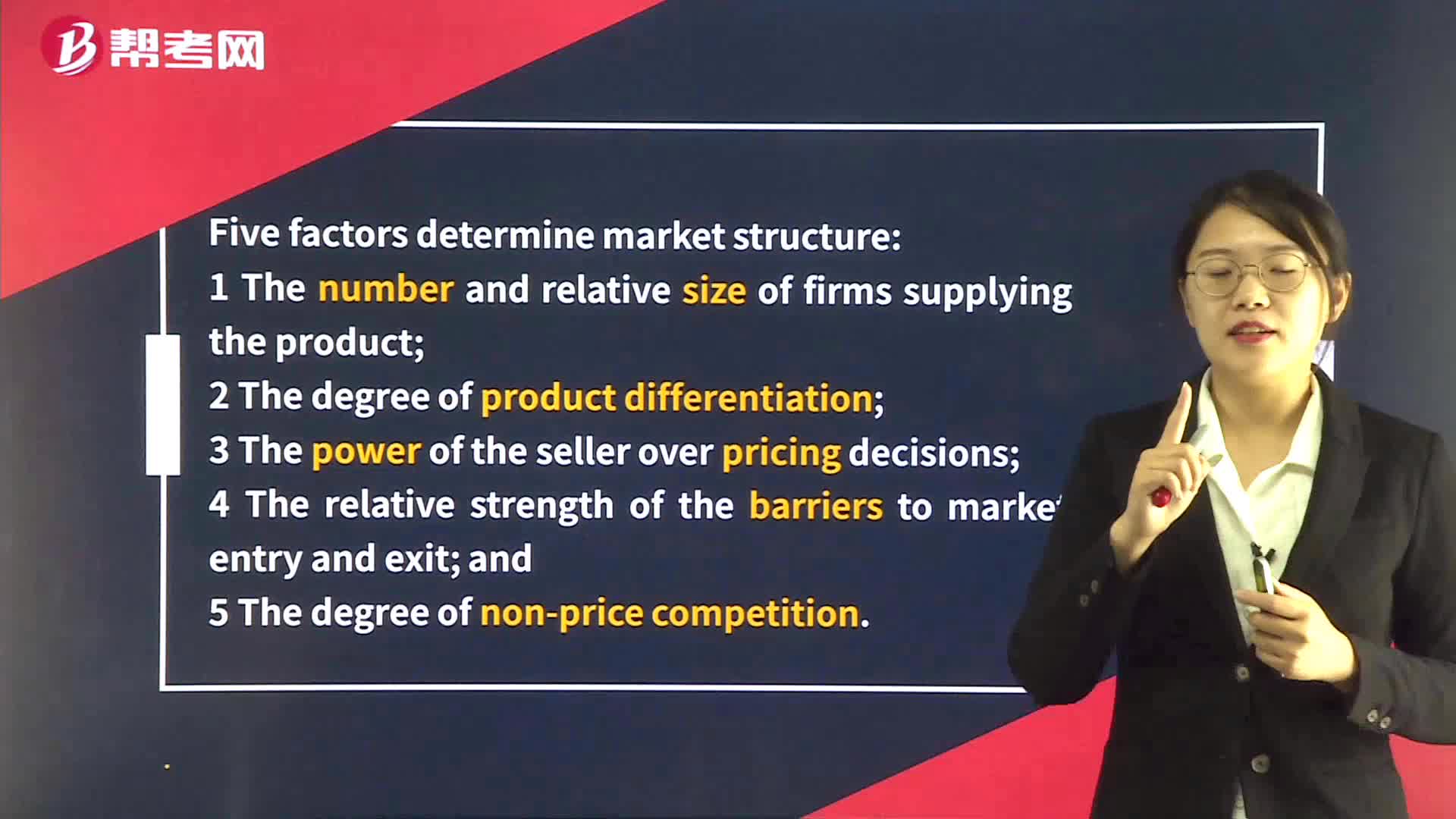

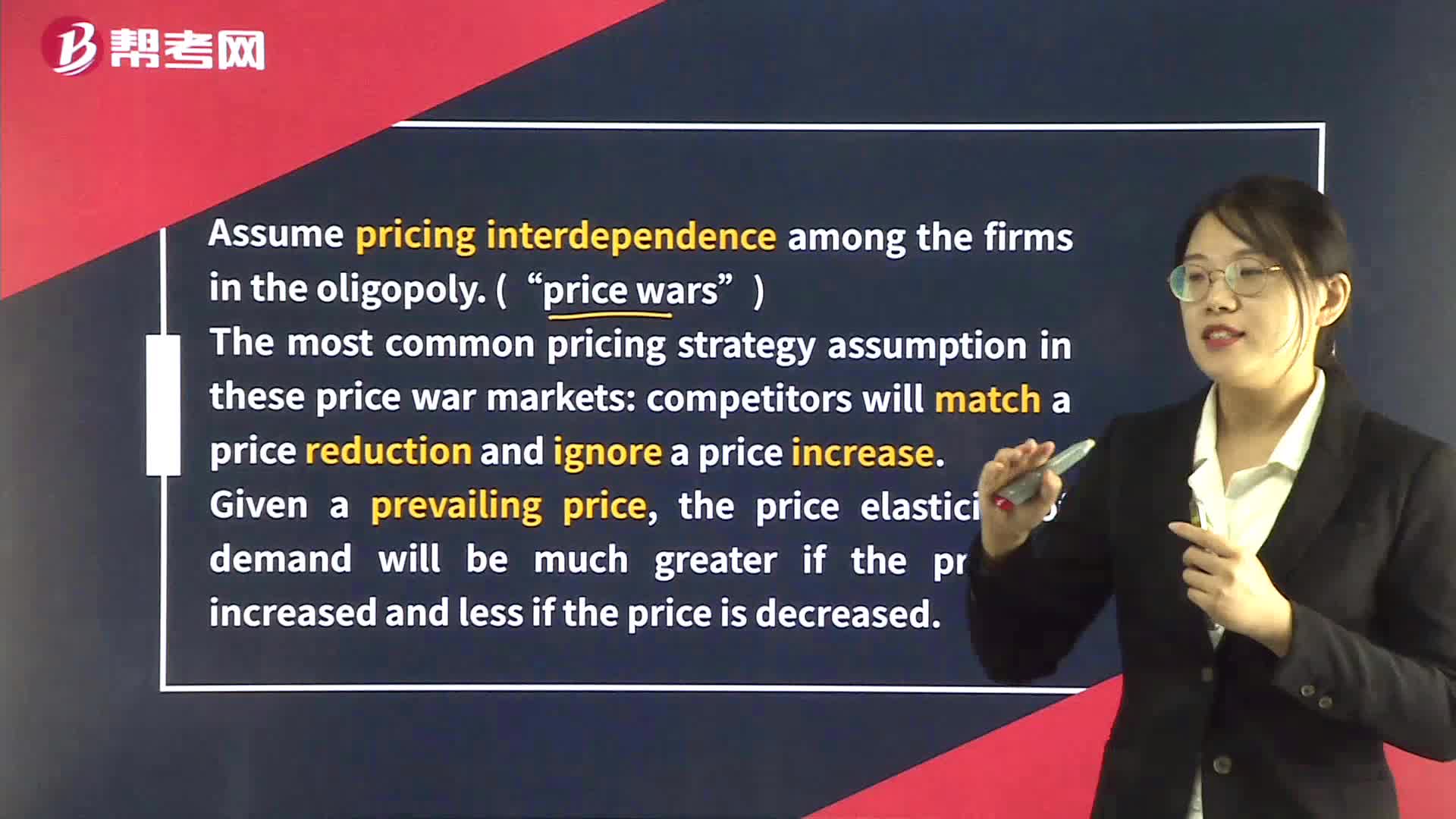

Kinked Demand Curve in Oligopoly Market

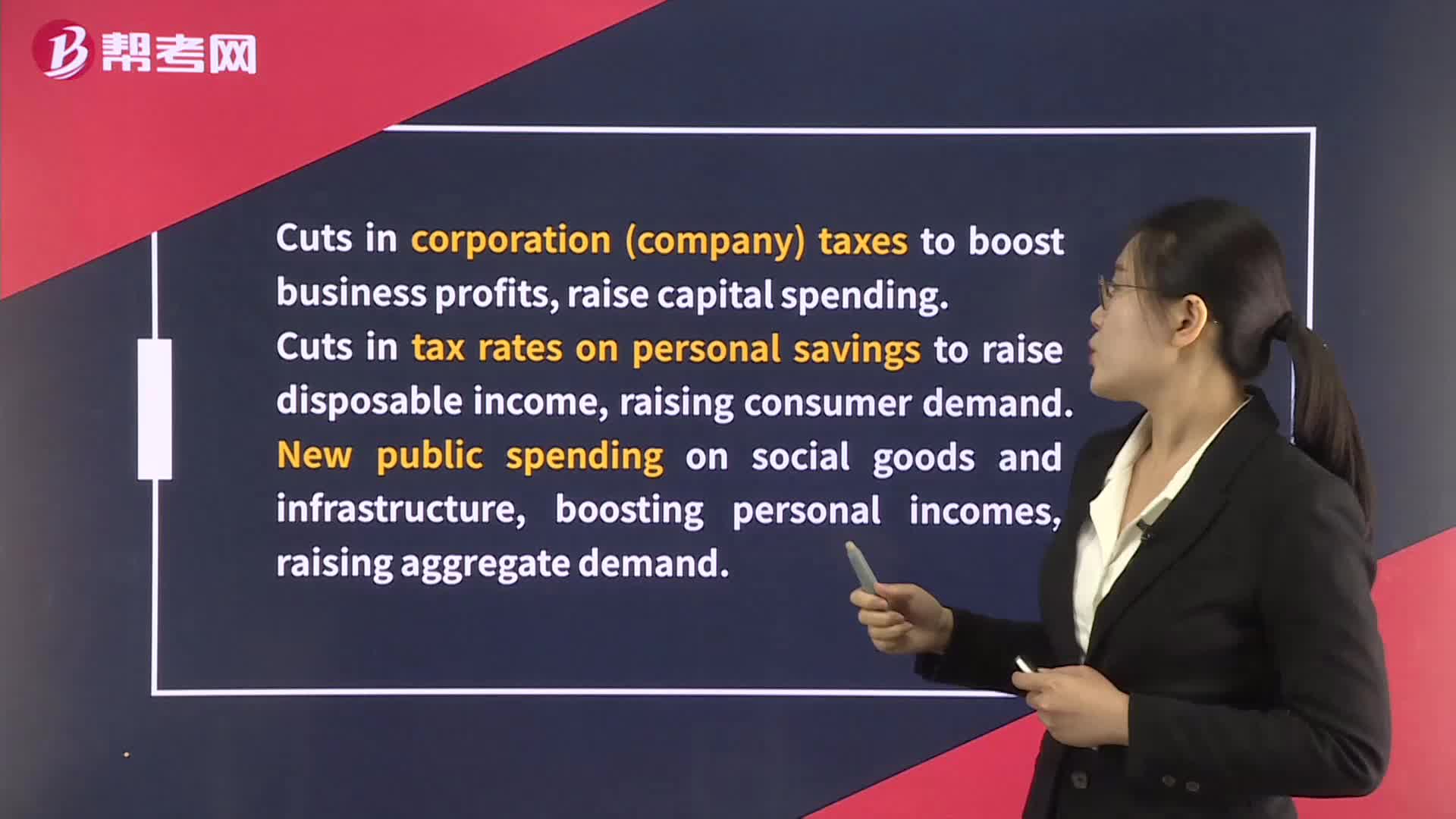

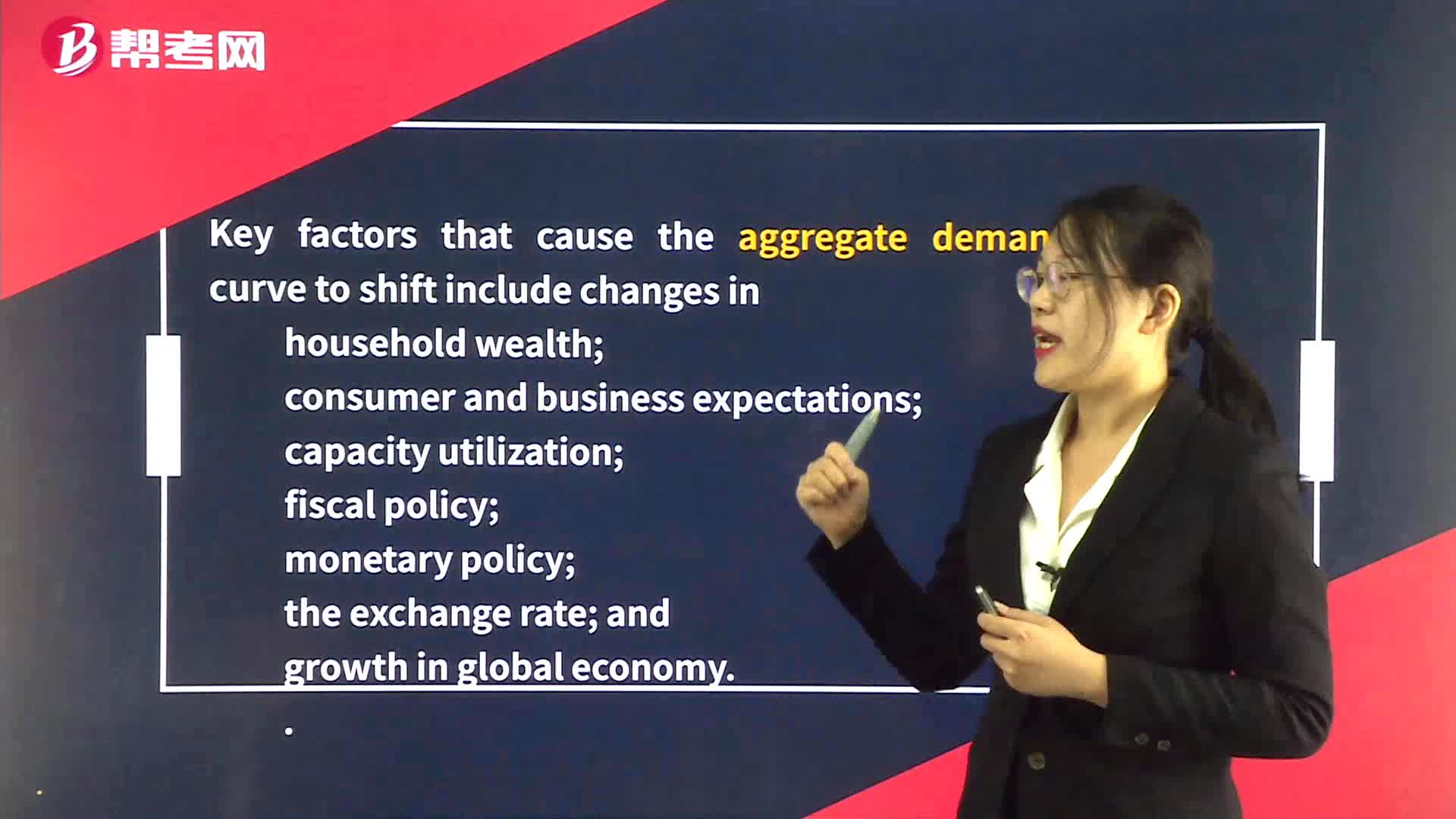

Shifts in Aggregate Demand

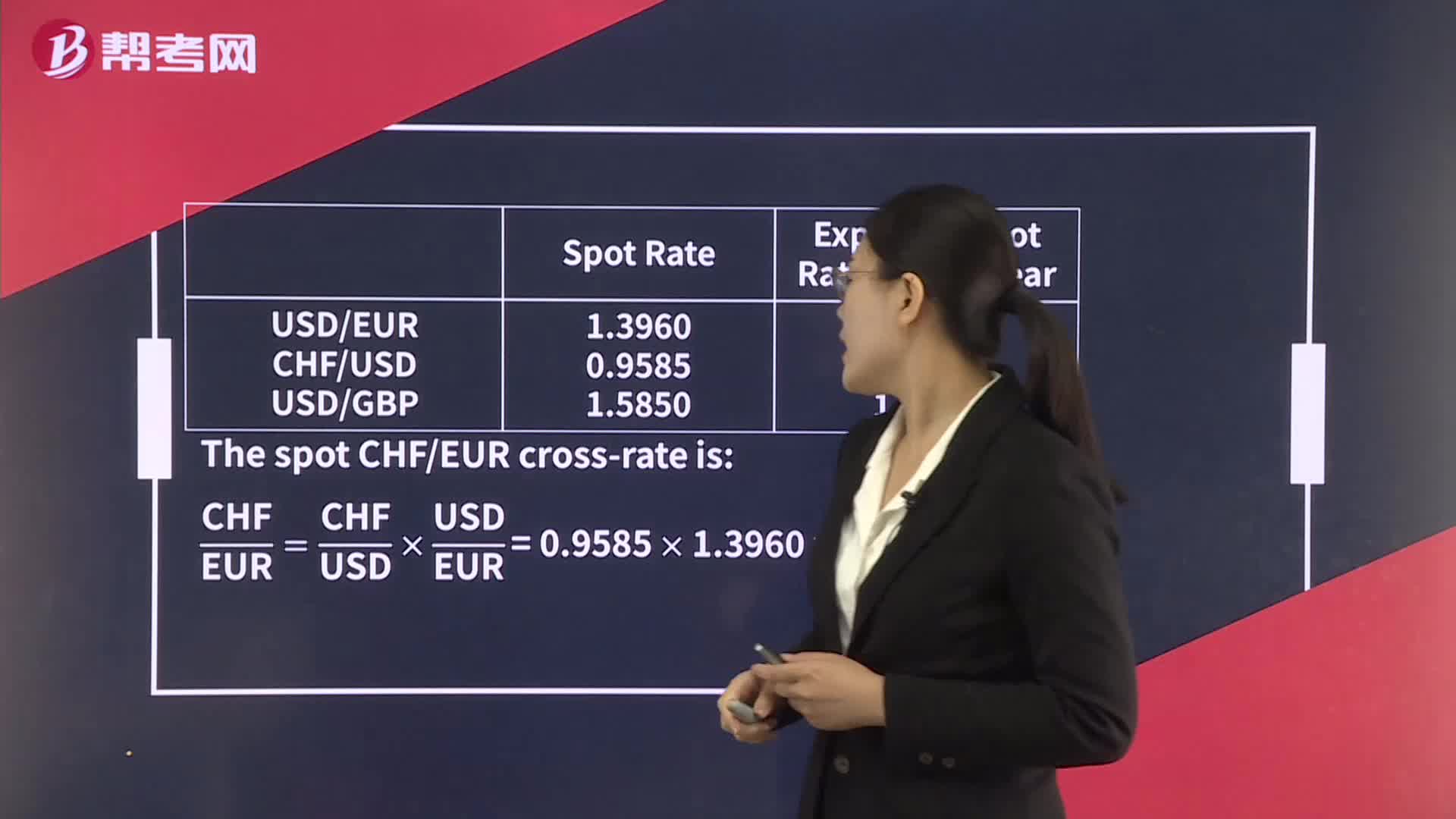

Cross-Rate Calculations

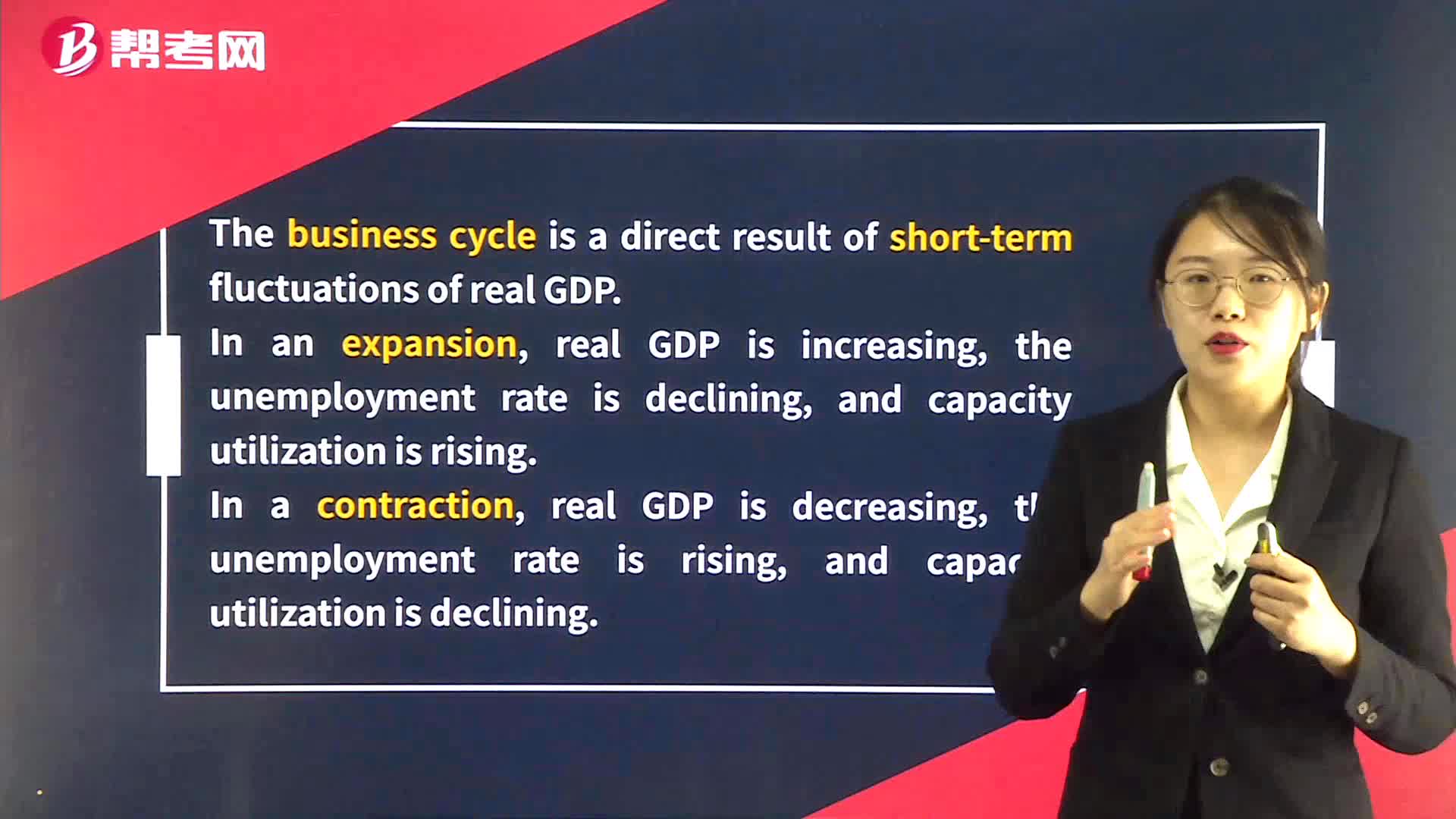

Shifts in Aggregate Demand and Supply

The Demand for Money

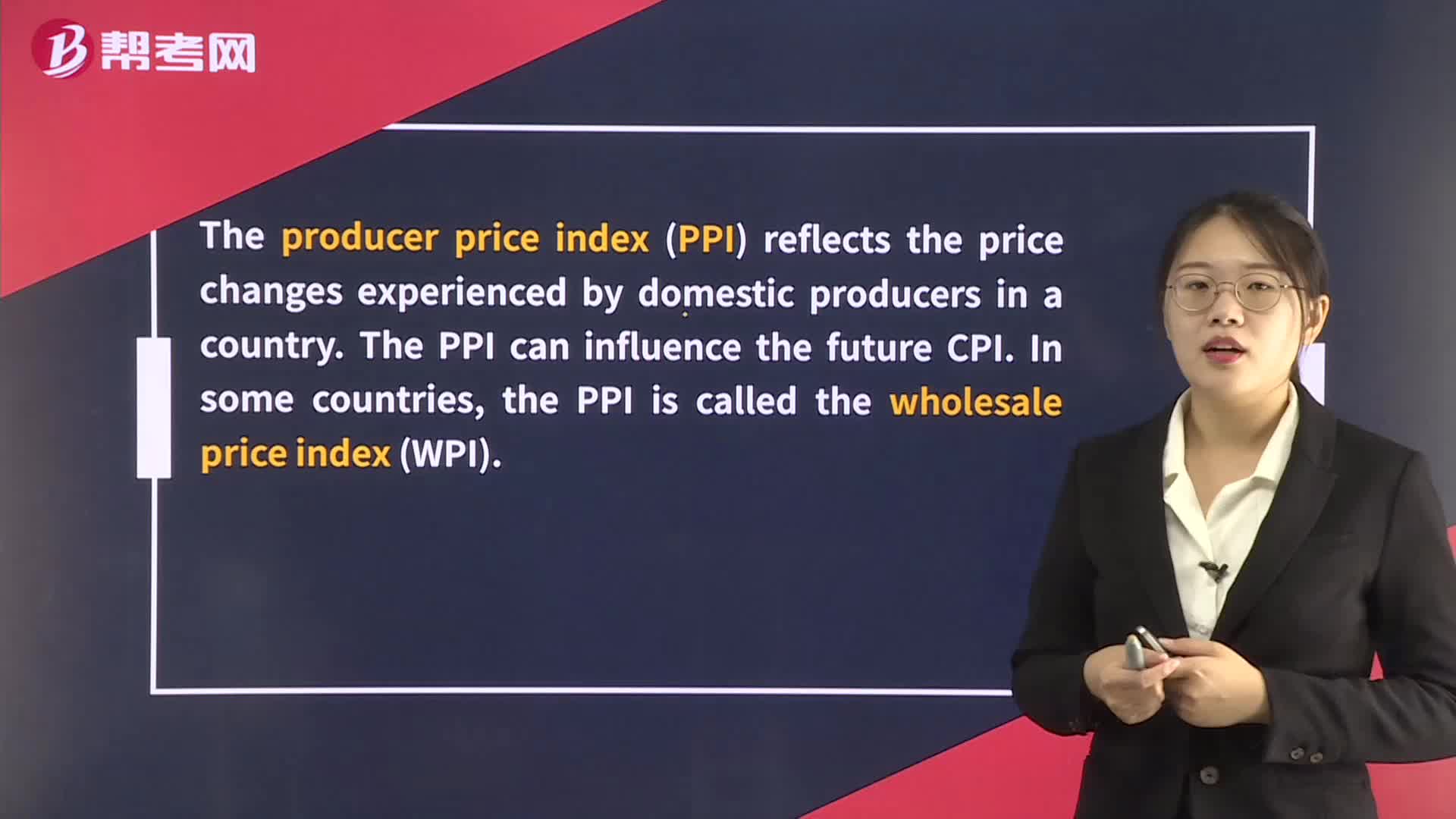

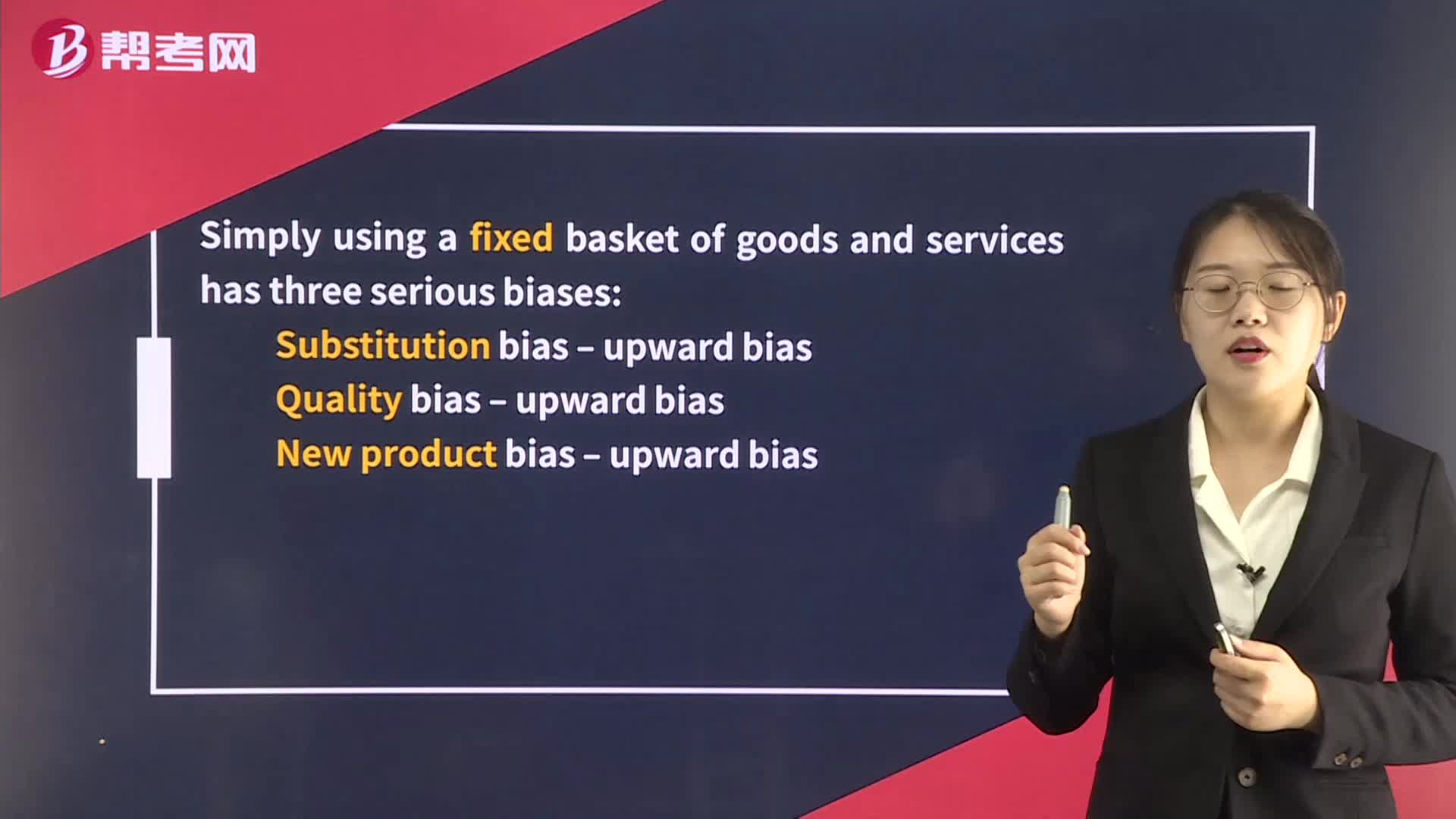

The Construction of Price Indexes

下載億題庫(kù)APP

聯(lián)系電話:400-660-1360