The Roles of Central Banks

The Objectives of Monetary Policy

The Neutral Rate

The Functions of Money

The Fisher Effect

The Costs of Inflation

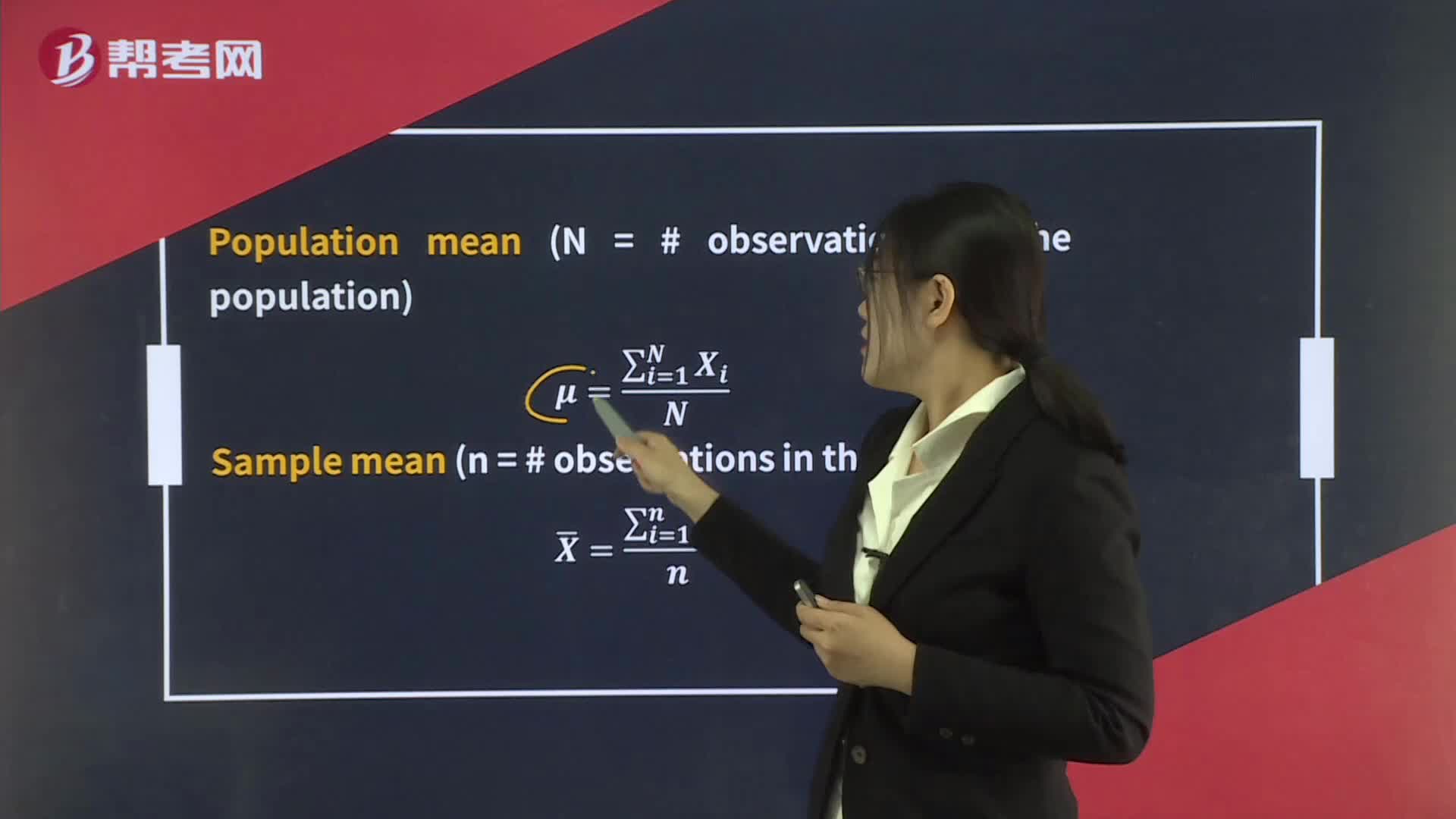

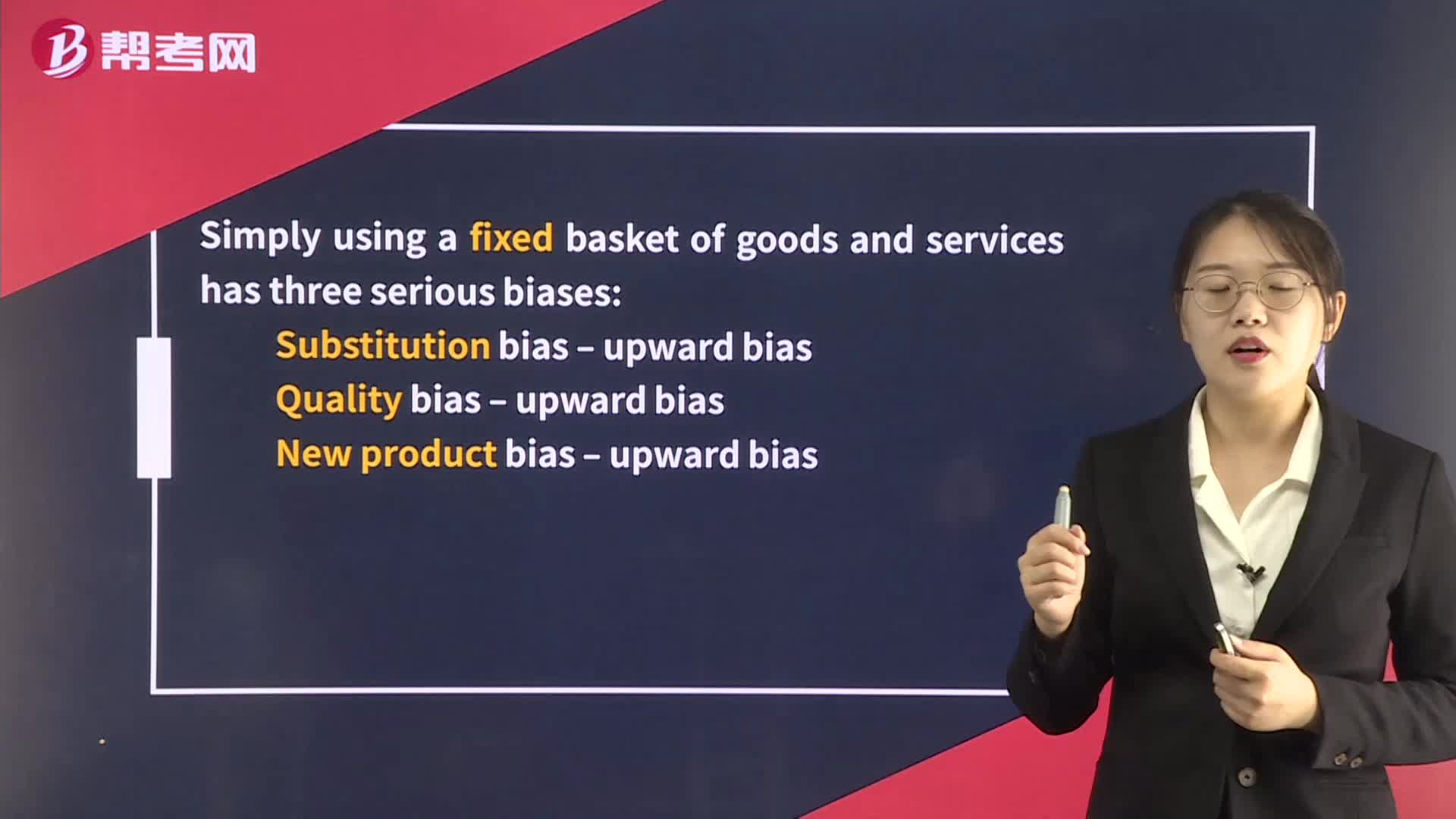

The Construction of Price Indexes

The Central Bank’s Policy Rate

The Advantages and Disadvantages of Using the Different Tools of Fiscal Policy

Factors Influencing the Mix of Fiscal and Monetary Policy

Theories of the Business Cycle - Neoclassical and Austrian Schools

Theories of the Business Cycle - Monetarist School

下載億題庫APP

聯(lián)系電話:400-660-1360