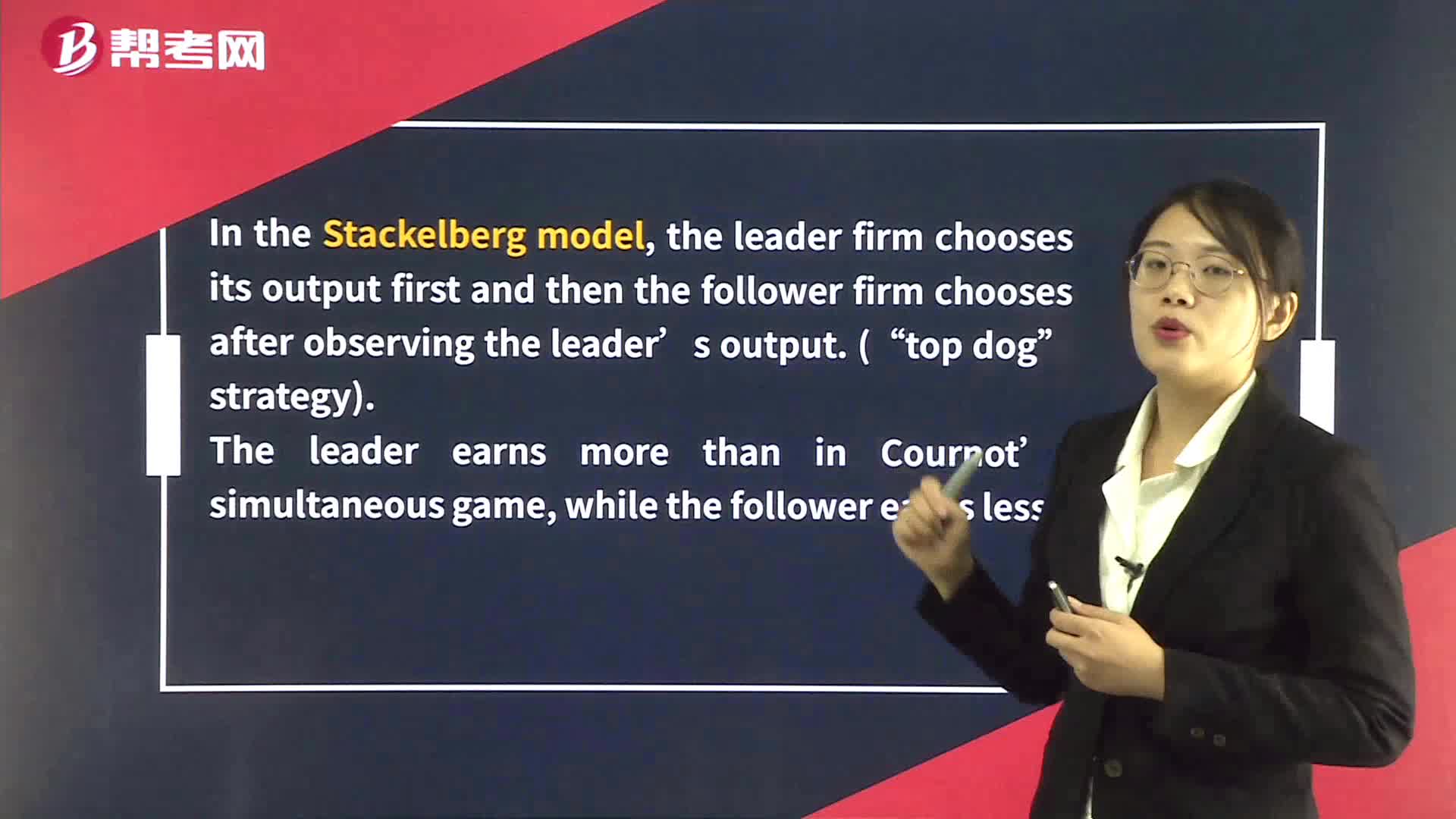

Stackelberg Model in Oligopoly Market

Supply Analysis in Monopolistic Competition

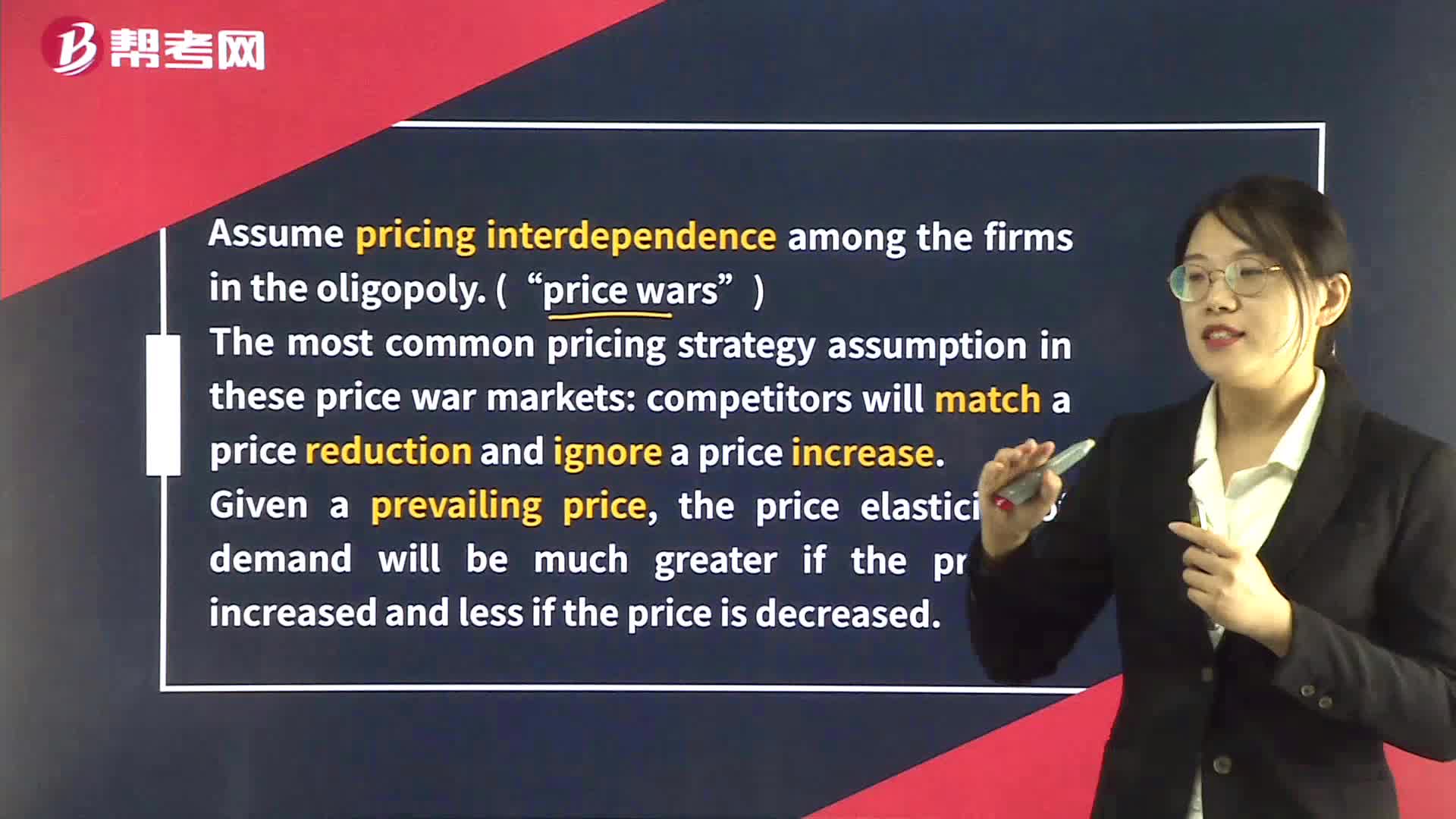

Pricing strategies in Oligopoly

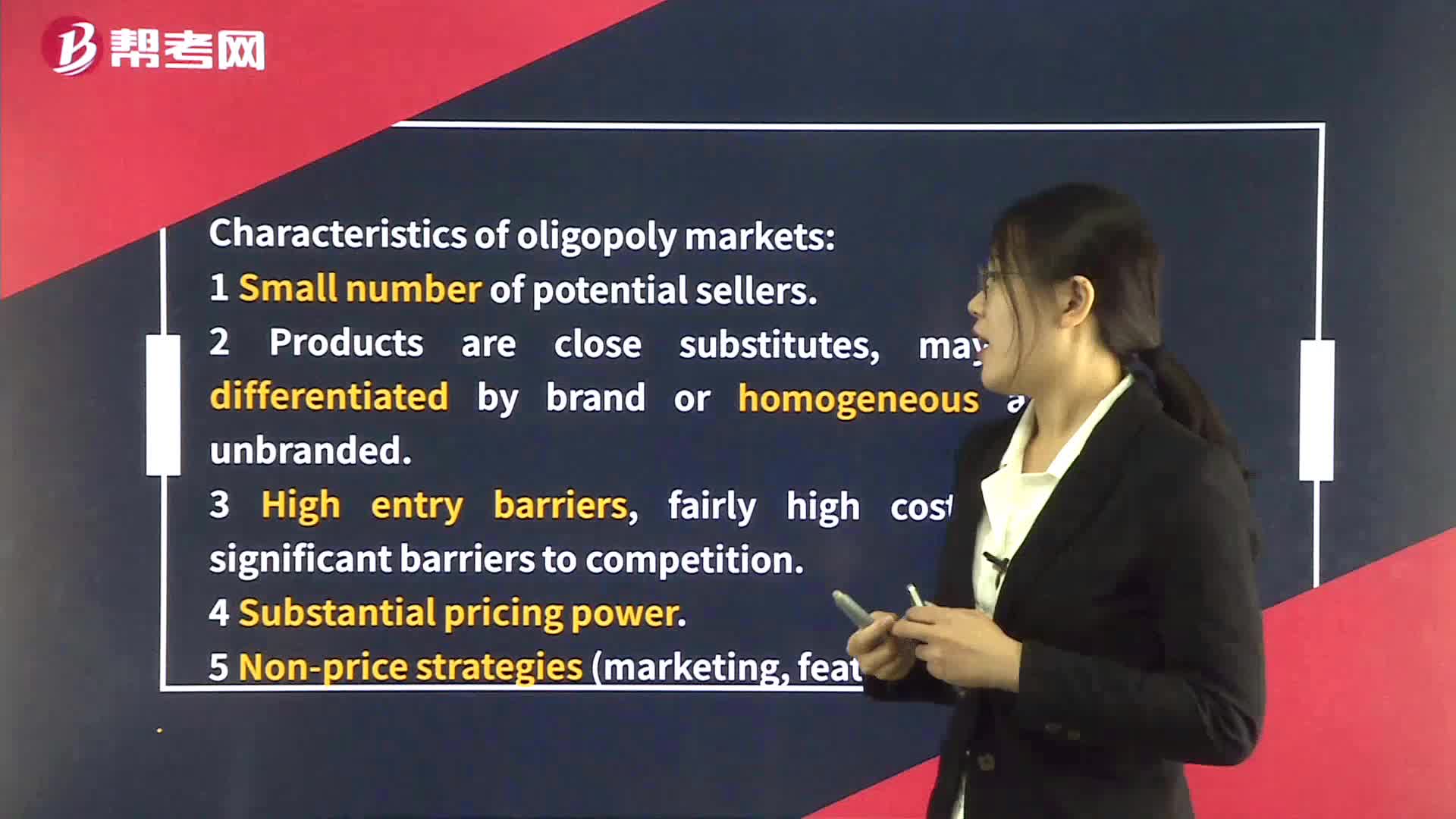

Oligopoly

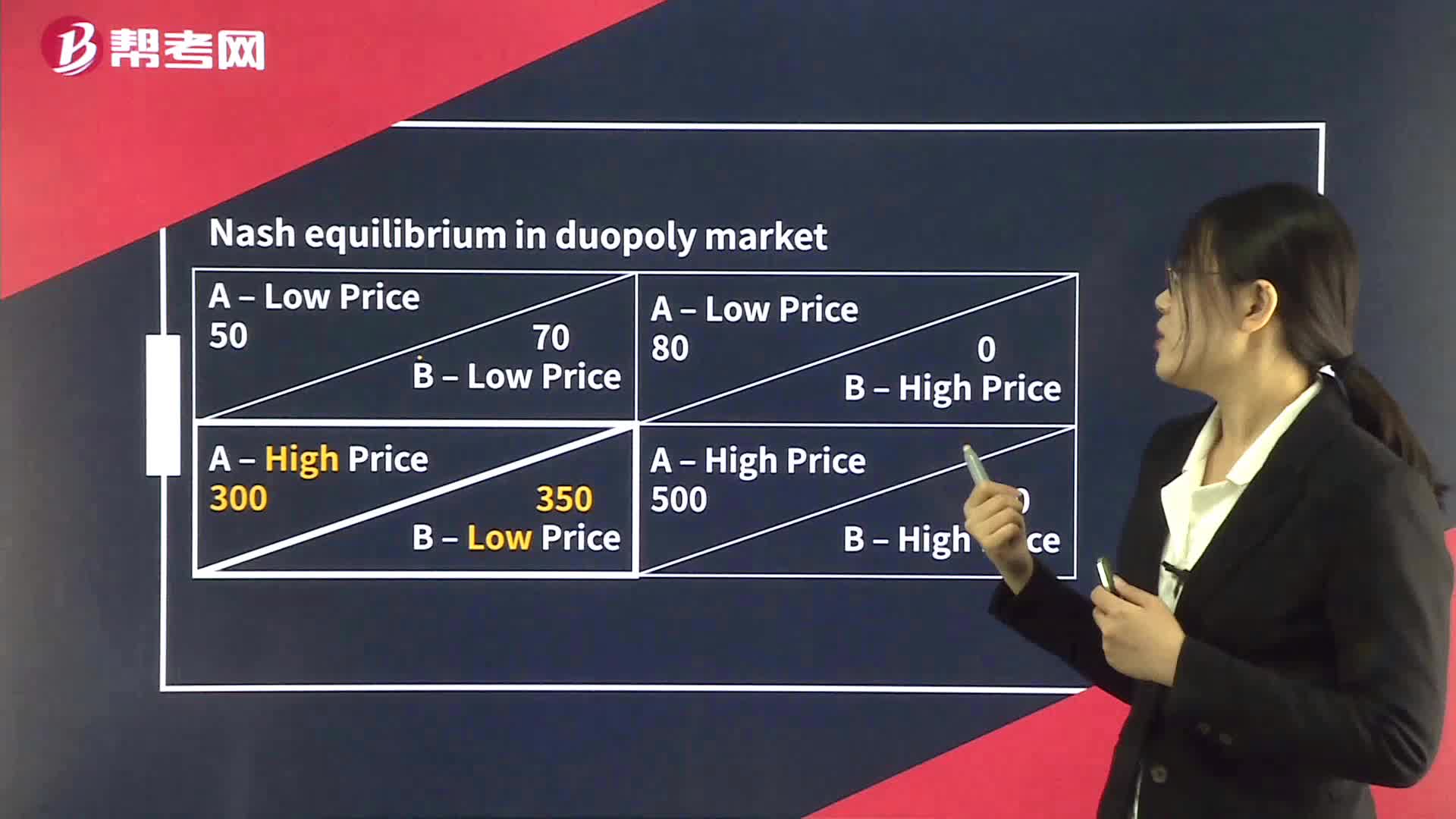

Nash Equilibrium in Oligopoly Market

Long-Run Equilibrium in Perfectly Competitive Markets

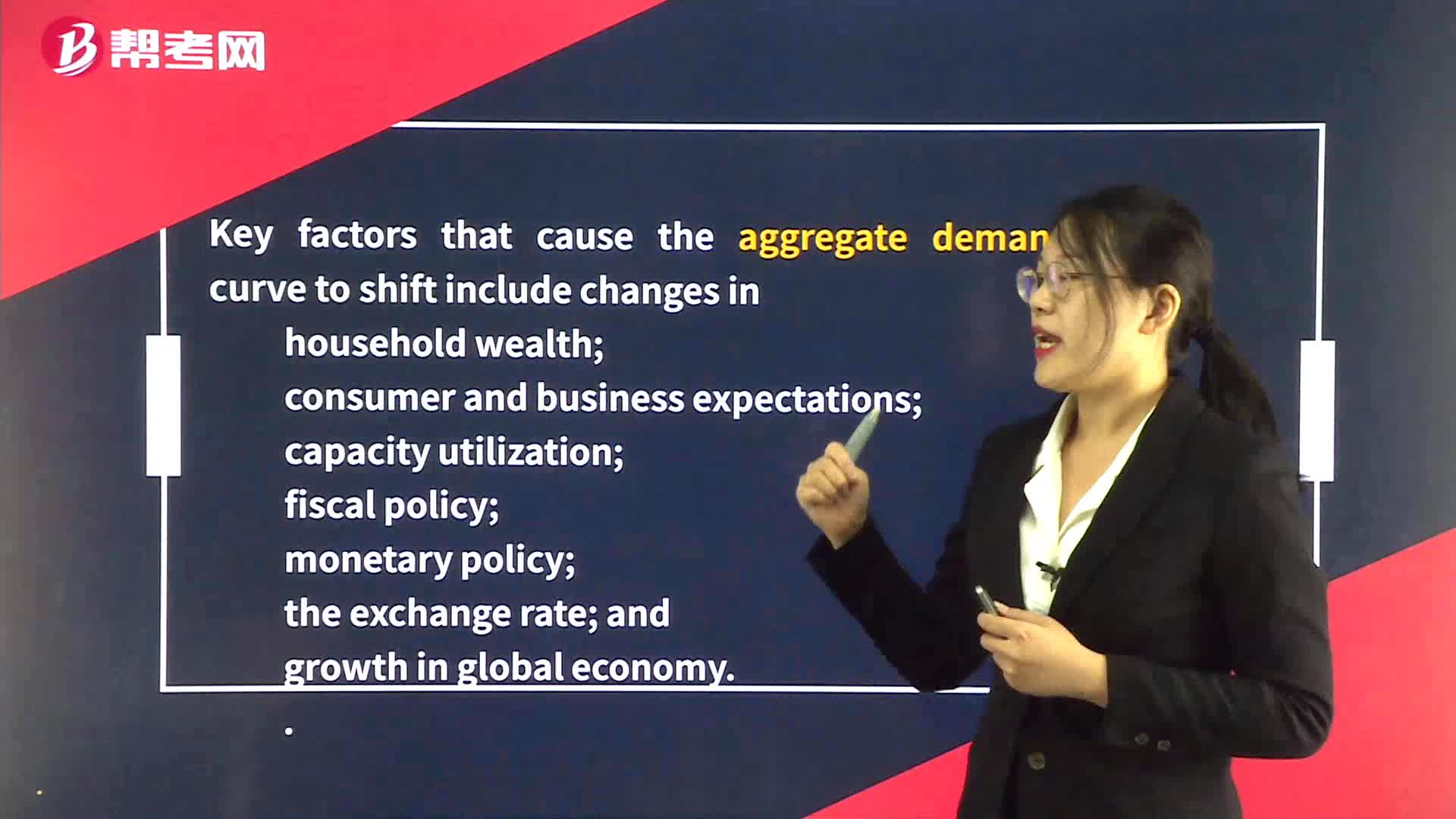

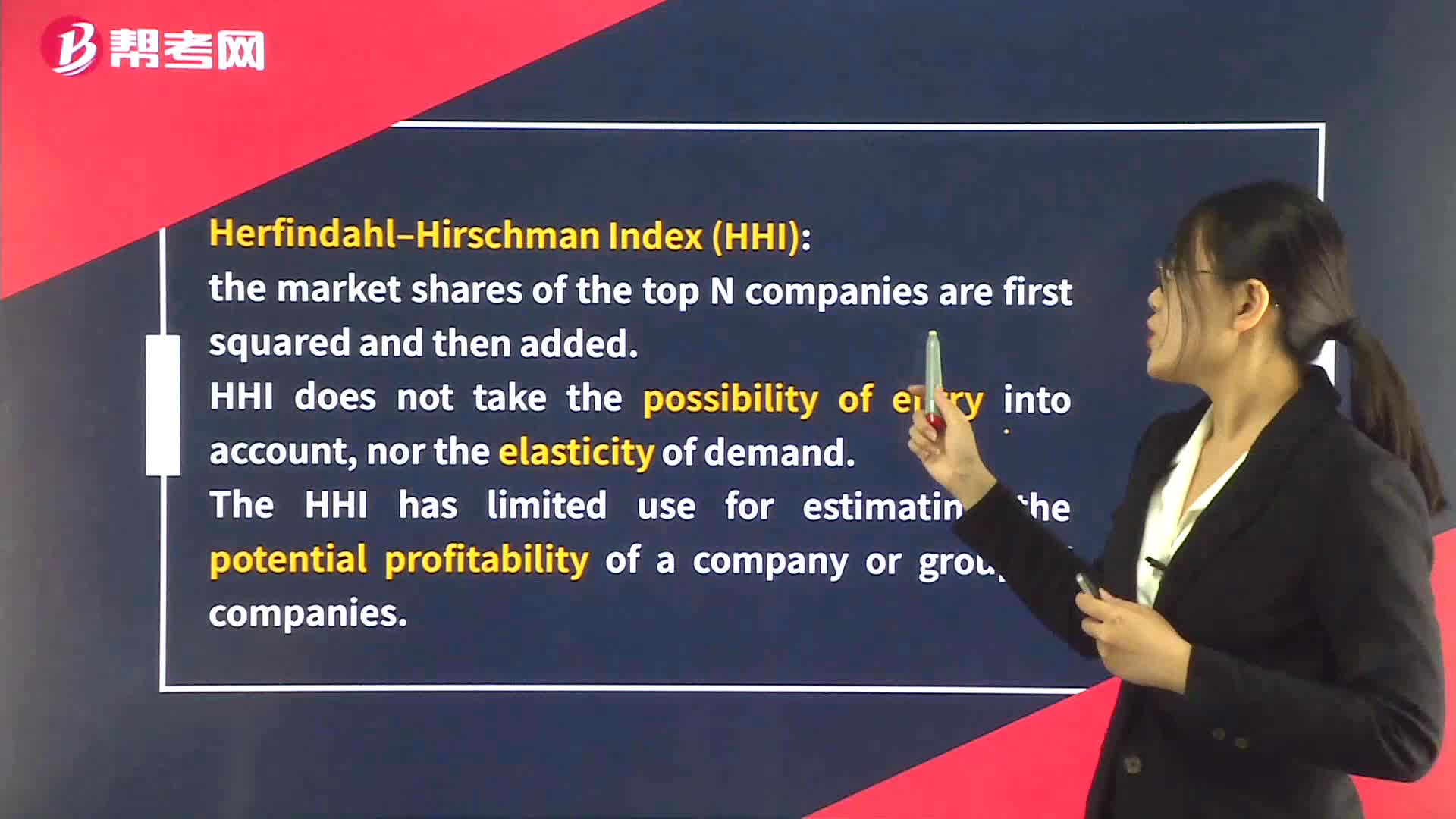

Market Structure

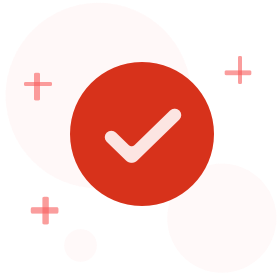

Shifts in Aggregate Supply

Long-Run Equilibrium in Oligopoly Market

Long-Run Equilibrium in Monopolistic Competition

Kinked Demand Curve in Oligopoly Market

Foreign Exchange Market Participants

下載億題庫APP

聯(lián)系電話:400-660-1360